There are many articles about the pros and cons of using a Self Directed IRA to invest in real estate. However, they often address two very different questions. The first is should a Self Directed IRA invest in real estate or should it stay in stocks? For that question, the pros and cons will focus on the virtues of real estate as a retirement asset.

The second is should you invest in real estate with a Self Directed IRA instead of investing in real estate straight? These points will be more about the platform than the asset. In the pros and cons that follow, we will be addressing both of these questions.

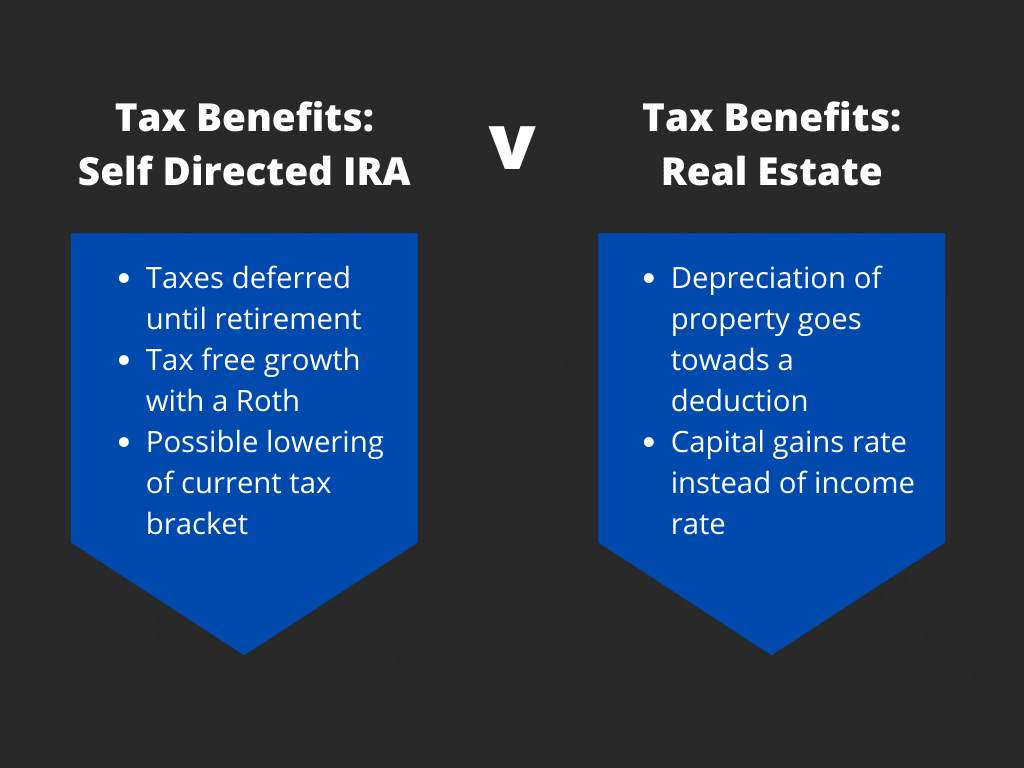

A Self Directed IRA is incentivized via tax benefits. In a Traditional Self Directed IRA, the contributions are tax-deferred. Taxes will eventually have to be paid, but not until retirement. Most retirees will be in a significantly lower tax bracket at that time and thus realize tax savings. The deferred taxes of a Traditional Self Directed IRA can also lower an investor’s current tax bracket.

A Self Directed Roth IRA works with post-tax dollars. This means that contributed funds are still considered earned income and pay their tax liabilities now. However, once the taxes are paid, the funds can grow tax-free. No matter how big the IRA grows, no more taxes are due and future distributions do not count as income.

When considering the pros and cons of investing in real estate with a Self Directed IRA, the tax picture is more complicated. That’s because real estate has built-in tax benefits that disappear in a Self Directed IRA. When investing with a retirement account, investors miss out on depreciation and a low capital gains rate. However, these factors are often offset by the tax-deferred or tax-free growth. The tax benefits of holding real estate in a retirement account are considered a pro because in many cases the investor comes out ahead.

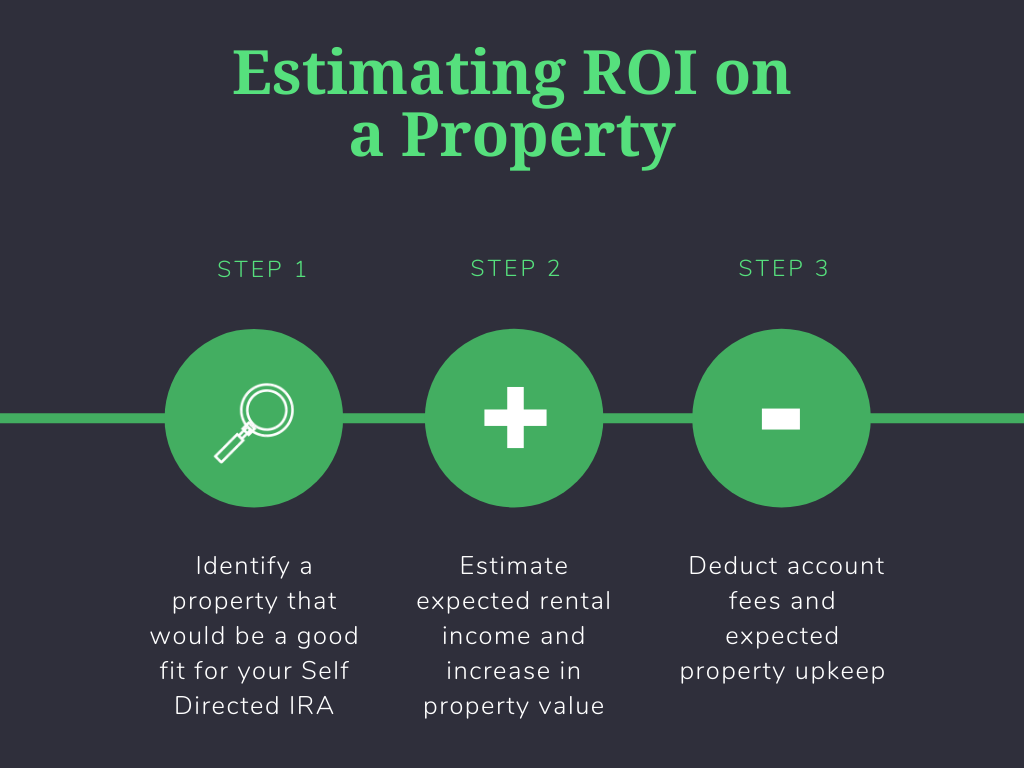

To find out if investing in real estate with a Self Directed IRA is a pro in your specific situation, just run the numbers. Estimate the income you expect from any real estate rental and the profit from a future sale. Then run those numbers through a straight investing scenario and a Self Directed IRA scenario. The answer will tell you if investing in real estate with a Self Directed IRA makes sense for your financial situation.

A big pro for investors who possess a self-directed mindset is full asset control. When you purchase real estate with a Self Directed IRA, you get to make all the decisions. These include which property to buy, how it should be renovated, and the dynamics of the selling process.

Having control removes a lot of the frustration of investing with a third party. With a Self Directed IRA, you know that your funds are being treated properly. Further, you can actively take steps to ensure the profitability of the property.

Which asset performs better in a Self Directed IRA over the long-term? Do stocks and other market products come out on top or does the advantage go to real estate? This is a hard question to answer because it is hard to quantify real estate profits. In addition to the value of the property itself, one has to consider income produced by rental units or leasing. Since rental income can vary so widely amongst different kinds of properties, it is hard to give an “apples-to-apples” answer.

One possible approximation can be found in a historical comparison of the stock market to REITs. The profitability of a REIT incorporates both property values and rental income. Comparisons show that over the long-term REITs provide higher returns.

Keep in mind that a REIT is not an exact model for a Self Directed IRA. A REIT will be able to take advantage of depreciation, which a Self Directed IRA cannot. On the other hand, the profits made from a REIT have already incorporated the 10% that goes to the management team. In a Self Directed IRA property, that profit goes to the investor.

The Self Directed IRA investor has yet another advantage when choosing real estate. They can be picky about which properties they choose. A REIT, surprisingly, doesn’t always have this luxury. The REIT can be under pressure to show growth and as a result might be less discerning in property choice. Focusing only on great real estate is often easier for a Self Directed IRA.

The pro of high ROI for real estate in a Self Directed IRA comes down to running the numbers. First, identify a specific property that you like for a Self Directed IRA. Then calculate income and growth against fees and expenses. Your estimate should give you a good sense if the property can potentially beat the stock market.

This is a pro that distinguishes between investing in real estate straight or investing within a Self Directed IRA. Sometimes an investor is forced to declare bankruptcy. In such cases, real estate in a Self Directed IRA is more secure. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 protects retirement accounts up to $1 million worth of assets. This is not true for a standard investment. In general, assets held in a retirement account are more secure than those that are privately owned.

Nobody has a crystal ball when it comes to investing. That is why almost every financial advisor promotes diversifying. The problem is that diversification is often framed in terms of market products. To truly reap the benefits of diversification, an investor would have to place funds across assets.

A Self Directed IRA allows this to happen in a way that a standard IRA cannot. A Self Directed IRA allows for investments in assets like physical real estate, a private company, and other alternatives. This doesn’t mean that an investor should move away from the market. Rather, a Self Directed IRA allows investors to expand their portfolio with different kinds of assets.

When discussing the pros and cons of investing in real estate with a Self Directed IRA, there are a lot of reasons to move forward. Increased ROI, diversification, and legal asset protection are all great pros. However, there are also cons to consider. These include real estate tax benefits, liquidity, and time commitment. Keep in mind, though, that there is a big difference between the two lists.

Most of the pros of investing in real estate with a Self Directed IRA apply to most investors. That is not true for the cons. Most of these reasons will not apply all at once nor to all investors. It’s likely that any given investor would only be affected by 1-2 cons.

Like with any investment, chart out the pros and cons that apply to your specific situation and then make a decision. As much as possible, a self-directed investor should avoid hype in either direction. It may not be as much fun to be sensible, but it will certainly be more productive. With that in mind, let’s look at some of the cons of placing real estate in a Self Directed IRA.

If you invest in a mutual fund, the drain on your time will be minimal. After the initial setup, it will consist mostly of reviewing documents every so often. The same is true if you use a Self Directed IRA to invest in real estate with a private placement. After the initial setup, you won’t really have much to do. Whoever is managing the property will be doing the day-to-day work.

The reality is different if you use a Self Directed IRA to buy a property privately. As the owner of the property, you’ll be involved in active management. Keeping in mind prohibited transactions, you will be involved in hiring contractors, rent collection, and other administrative duties. If your life is too busy now, you may not want to add a piece of real estate to the mix.

Most self-directed investors embrace the fact that they can play an active role. This is part of the appeal of the Self Directed IRA. It allows account holders to have more involvement with their investments and put in the effort to make them successful.

If the time commitment still sounds overwhelming, an alternative is to hire a third-party management company. They will take care of your property and allow you to focus on other things. Obviously that company comes at a cost, but it may be worth it. When you run the numbers, you can explore both avenues and see which one best fits your goals.

Liquidity is a con that is relevant to investing in real estate as opposed to stocks. Stocks are amazingly liquid in the sense that you can cash out quickly. Real estate is not that liquid. If you want to sell a property, it usually requires several weeks (if not months) before the sale comes to fruition.

This is the reason why so many retirement investors look at real estate for a Self Directed IRA. Funds placed in it are not meant to be spent right now, but rather invested for the long term. That’s why real estate is a good fit for a Self Directed IRA. Since you won’t be constantly dipping into the account, you can utilize it to profit from real estate and its long window.

However, the liquidity con of real estate in a Self Directed IRA does get practical for Required Minimum Distributions (RMDs). When an investor hits the age where they are to start taking distributions, most do so by taking a percentage of the IRA every year. This can be tricky with real estate because how do you take a piece of the land? Selling it in portions is usually not feasible or economical.

There are four main ways to take an RMD from real estate in a Self Directed IRA. These include using other accounts or making an in-kind distribution. The right method will depend on your personal circumstances. You can find out more about taking an RMD from real estate here.

Fees can certainly be a con when placing real estate in a Self Directed IRA, but they don’t have to be. Most of the complaints regarding Self Directed IRA fees usually stem from the investor not being advised on the right kind of account. There are a number of different Self Directed IRA accounts and the fee structures vary widely. (Even for the same kind of Self Directed IRA account, different companies can have different pricing systems).

From a fee perspective, let’s address two basic Self Directed IRA accounts. First, a custodial Self Directed IRA has a low setup fee but charges for every transaction. That makes it a good fit for investing in property with a private placement. Since there will be few transactions, this account will be more economical.

On the other hand, a Self Directed IRA with checkbook control has a higher setup fee but no transaction fees. That makes it well suited for actively managing a property. With a little bit of research, you should be able to determine the nature of your intended real estate investment and choose the right account.

In addition to the fees, real estate itself is a rather pricey asset. Property isn’t cheap, and if you want to own a property, it will require a high initial investment. This isn’t so much a con, as it is the reality of the asset. If an investor wants to pursue real estate but doesn’t have the required funds, they should consider alternatives like private placements or REITs.

One of the cons presented when investing in real estate with a Self Directed IRA is the need to be ERISA compliant. (ERISA is the federal law that governs retirement accounts). In a Self Directed IRA, the investor has more freedom and thus needs to be more aware of governing regulations. Although being compliant is extremely important, the pertinent regulations (like prohibited transactions) are fairly simple to learn and easy to implement.

As discussed, investing with a Self Directed IRA provides tax-free or tax-deferred profits. However, there is a loss of real estate tax benefits that can be obtained if invested straight. Real estate as an asset has two major tax advantages. The profit from the real estate will be considered capital gain (as opposed to income) and thus enjoy a lower tax rate. Secondly, depreciation of the property can be used for a tax deduction. When real estate is in a Self Directed IRA, the profit will be counted as income and depreciation will not be considered.

Is this enough to break the deal? Each situation is different, and you just have to run the numbers. For the specific property that you are considering, determine the expected returns with the tax advantages of a Self Directed IRA and the expected returns of purchasing the property not within a Self Directed IRA.

The pros and cons of investing in real estate with a Self Directed IRA can be persuasive in either direction. High ROI and better diversification are certainly advantages, while the time commitment and loss of certain tax benefits can make an investor hesitate. As we’ve seen, most of the cons are situation specific and they won’t necessarily apply to your specific strategy. The best path forward in all cases is to get educated, run the numbers, and then make an informed decision.

Still have questions about Self-Directed IRAs?

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST