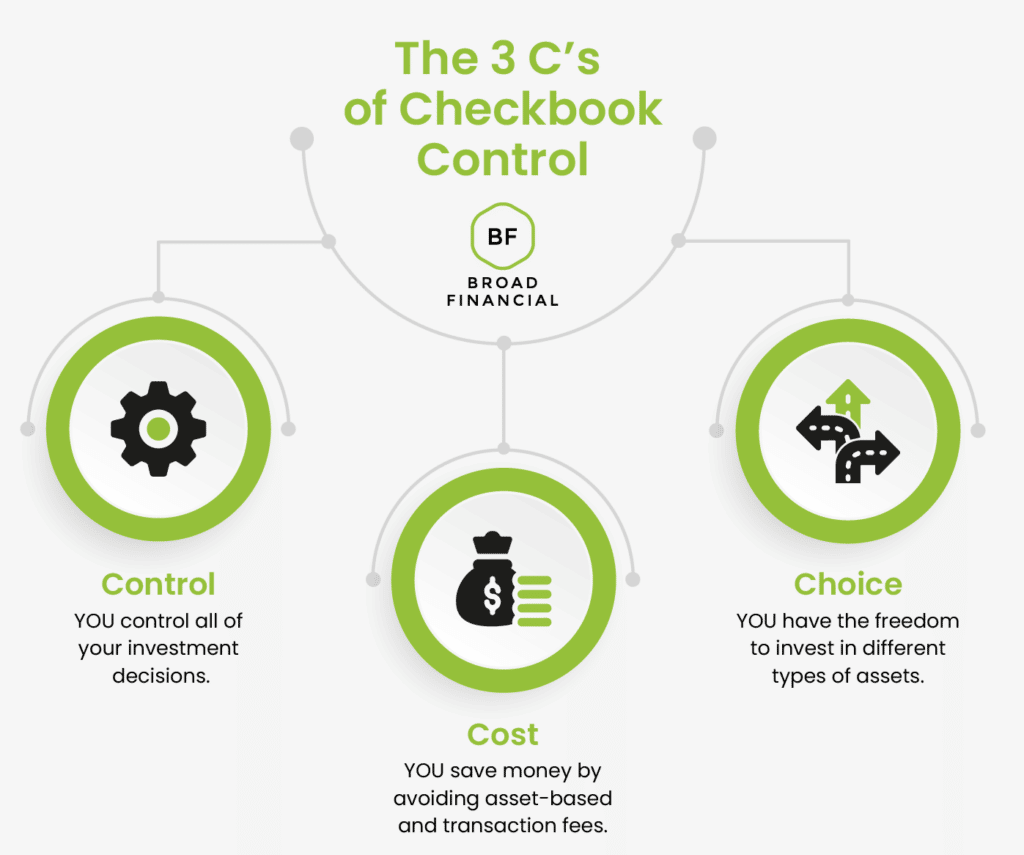

The investment process for a Self-Directed IRA LLC with checkbook control is easy and hassle-free. Purchase an asset by simply writing a check or sending a wire from your dedicated checking account and the asset is automatically owned by your IRA.

The dedicated IRA LLC checking account allows you to make investments in real time and avoid the expensive transaction fees that are normally associated with Self-Directed IRAs.

Unlike other self-directed retirement plans, an LLC provides asset protection that safeguards the IRA, IRA owner, and IRA custodian from liabilities that may arise from investments owned by the IRA LLC. This additional layer of liability protection is not found in a classic Self-Directed IRA.

Do you have questions about the Self-Directed IRA process? Speak with a Broad specialist and get answers.

Schedule a CallIf you're unsure which account is best for your investment, take our short quiz!

Take the Quiz

The short answer is yes; you can set up an IRA LLC on your own. However, you must ensure that the LLC is set up according to IRS and ERISA (Employee Retirement Income Security Act) laws to obtain tax advantages. That means you must take particular care with the IRA LLC Operating Agreement. Essentially, the IRA LLC Operating Agreement must state that the LLC will operate according to the rules and regulations of ERISA law.

By choosing Broad Financial to set up your IRA LLC, you can be confident that your account is set up correctly. Broad Financial will create a specialized, IRS-compliant LLC for your IRA and take care of the paperwork so you can have a seamless experience.

You have the freedom to set up a designated IRA LLC checking account at the bank of your choice. Typically, the Self-Directed IRA LLC account holder is the non-compensated manager of the LLC and manages the investments through the IRA LLC checking account.

The designated IRA LLC bank account gives you the power to write checks on behalf of the Self-Directed IRA without having to go through the custodian for each transaction. The IRA LLC bank account provides speed, reduced cost, and flexibility.

No, the LLC does not have to file a tax return. Since the self-directed retirement plan's LLC is set up as a pass-through entity, there is no corporate tax and no personal tax required. This is because the Self-Directed IRA (not the account holder) owns 100% of the LLC, which is tax-sheltered.

Complete Broad Financial’s easy online application. Simultaneously, open a new Self-Directed IRA with our sister company, Madison Trust. Madison Trust serves as your IRA custodian and Broad Financial upgrades you to the IRA LLC.

Next, transfer or roll over funds from a previous retirement account, such as an IRA or 401(k), or make an initial contribution.

Checkbook Control is the term used when a Self-Directed IRA account holder has complete signing authority over an account that has access to their retirement funds. With checkbook control, the account holder can invest directly in alternative assets without the need for a custodian to perform everyday transactions. A Self-Directed Checkbook IRA LLC provides the ability to act on time-sensitive investments and eliminates transaction fees. The checkbook control strategy is achieved through the establishment of an LLC owned by the Self-Directed IRA.

Yes! An IRA LLC can be opened as a Roth IRA. In a Roth IRA, the account holder pays taxes up front, and in turn, all investment earnings can be taken out tax-free in retirement. You may also choose to have a Traditional, SEP, SIMPLE, Inherited Traditional, or Inherited Roth Self-Directed IRA.

Broad Financial will complete the following:

• Register a limited liability company with the Secretary of State's office (typically in the state where the IRA property is located) and file articles of organization. Note that each state has different rules and regulations regarding establishing an LLC. You may want to review the rules for establishing an LLC in your state.

• Prepare a specialized LLC operating agreement with provisions related to the IRS and ERISA rules outlined in IRC Sections 408 and 4975, including prohibited transactions, disqualified persons, and undue compensation.

• Obtain an Employer identification number (EIN) for the LLC from the IRS. The EIN is associated with your IRA, notifying the IRS that the LLC is a tax-advantaged account.

• Provide you with a simple IRA LLC user guide that outlines what you can and cannot do within your IRA LLC.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST