Invest in real estate and other assets by writing a check or sending a wire.

Transactions happen in real time and do not require custodian paperwork.

Swap assets in your account at any time.

Checkbook control eliminates transaction fees.

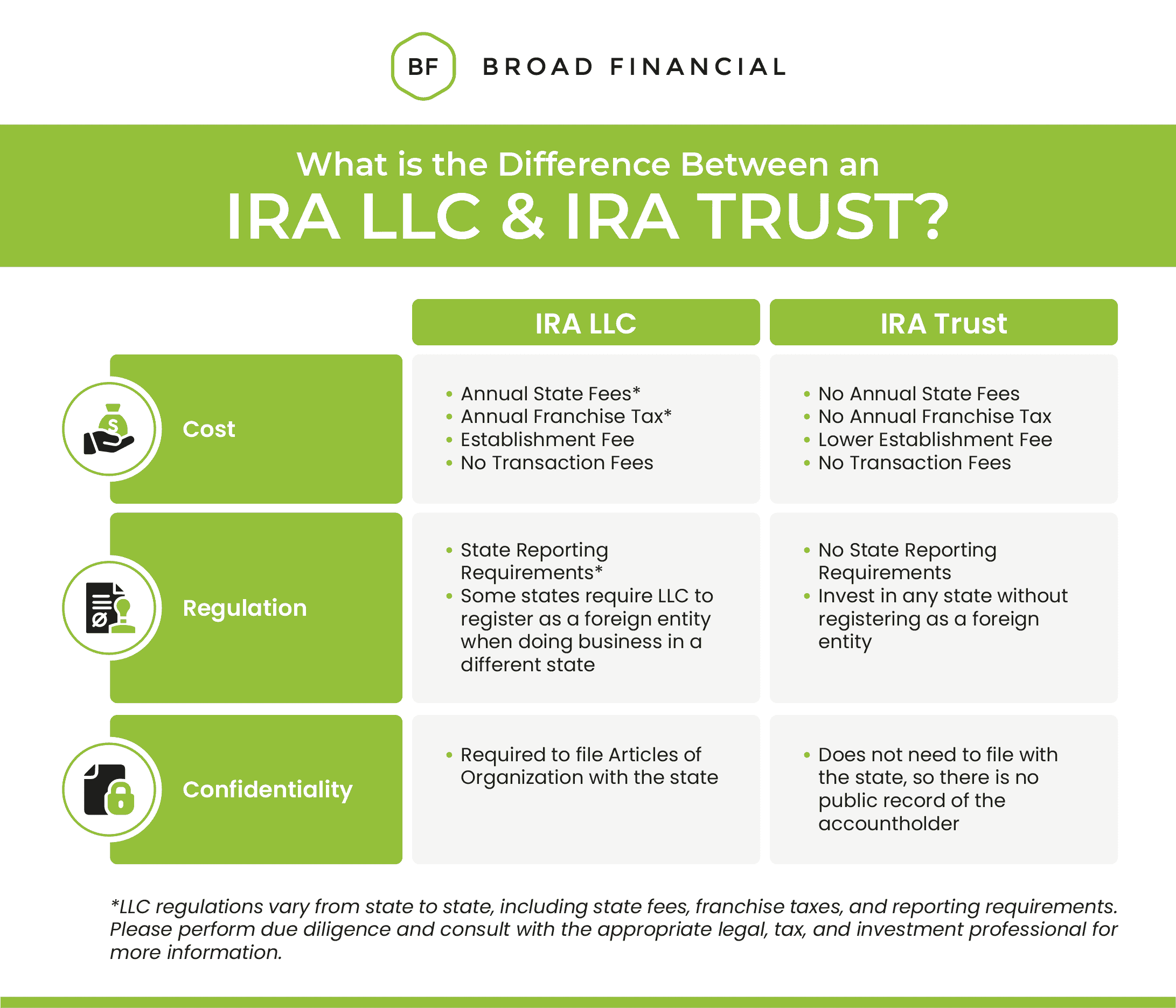

Trusts are not registered by the state so they avoid annual LLC state fees.

An IRA Trust is easier, quicker, and more economical to set up than an IRA LLC.

An IRA Trust has no state reporting requirements.

LLC Articles of Organization are not required, which means no public records.

Generally, you can invest in any of the 50 states without any additional filing requests.

An IRA in a trust is ideal for any investment that can benefit from checkbook control. This includes alternative assets like real estate that require consistent management, as there are no transaction fees, with the added benefit of no additional custodian paperwork.

With an IRA Trust, you can invest in:

Do you have questions about the Self-Directed IRA process? Speak with a Broad specialist and get answers.

Schedule a CallIf you're unsure which account is best for your investment, take our short quiz!

Take the QuizChoosing the best Self-Directed IRA Trust company is the most important part of setting up your new account. Fill out Broad Financial’s simple online application. At the same time, open a Self-Directed IRA at Madison Trust, our sister company. Madison Trust is your IRA custodian and Broad Financial upgrades you to an IRA Trust.

Next, fund your account through a transfer or rollover from an existing retirement account, such as an IRA or 401(k), or make an initial contribution.

The two times when an investor may opt for an IRA LLC over an IRA Trust are for multi-member capability or foreign assets. However, in most cases, the IRA Trust is faster and more economical while still providing the same robust checkbook control.

Yes; you can open your trust as a Self-Directed Roth IRA Trust. If you prefer to pay your taxes up front, then a Roth IRA is the choice for you. Depending on your investment strategy and tax preference, you may also choose to open a Traditional, SIMPLE, SEP, Inherited Roth, or Inherited Traditional Self-Directed IRA.

Both IRA LLCs and IRA Trusts benefit by having the checkbook control ability to make fee-free transactions. However, with an IRA Trust, you save on several LLC-associated fees. An IRA Trust does not have to pay the (often hefty) annual LLC state fees or pay the annual franchise tax that some states impose on LLCs. An IRA Trust is also simpler to set up, resulting in a lower establishment fee.

Do you have questions about self-directed investing process? Speak with a Broad specialist to get answers.

Schedule a CallStart diversifying today with a Self- Directed IRA. You can apply online in just ten minutes.

Apply OnlineAddress:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST