This year investors have been hit hard with high inflation, interest rates hikes, supply chain issues, and global conflicts. As a result, there has been increased short-term volatility, with both the stock and cryptocurrency markets taking a hit. It’s only natural for investors to wonder about the future of the economy and whether cryptocurrency will continue to hold value.

Of course, there is no investment without risk and no guarantee of future performance. However, there are a few reasons pointing towards crypto holding value in the long run. Accounting for its potential for substantial returns, you may want to consider investing in crypto with your retirement funds using a Crypto IRA.

Last year, popular cryptocurrencies like Bitcoin and Ethereum hit all-time highs in November 2021, with Bitcoin reaching above $68,000 and Ethereum hitting a high of $4,865.57. For those that invested early, this likely created a great return on investment. However, these investors may have also seen a large tax bill if they sold their coins.

Instead, investors may look to be more tax-efficient by adding crypto to their retirement portfolio. Let’s compare the tax difference between investing in crypto outside of an IRA and buying crypto in an IRA.

Assume you purchased five Bitcoin on December 10, 2021, for $18,245.50 each. Then, you decided to sell them on April 29, 2022, when they were valued at $38,593.02 each.

A total of $101,737.60 would be subject to tax, as you pay taxes on the gain received ($192,965.10 minus $91,227.50). Since the Bitcoin was sold before being held for a year, this is considered short-term capital gains for tax purposes. The profit of $101,737.60 is counted as ordinary income, which increases your taxable revenue and may even push you into a higher income tax bracket.

On the other hand, if the Bitcoin was bought in your Self-Directed Crypto IRA, you would be exempt from capital gains tax at the point of sale. You can trade digital currencies freely without being taxed and do not need to report the sale price or cost basis for every trade.

Since Crypto IRAs are structured and function like Self-Directed IRAs, IRA tax rules still apply. Depending on the retirement account type selected when the Self-Directed IRA account was open, taxes will either be paid upfront and grow tax-free (Roth IRA) or taxes will be deferred and paid when withdrawing the IRA funds (Traditional IRA).

Typically, investors are told to diversify their portfolio across standard assets like stocks, bonds, and mutual funds. However, the savviest investors understand that the best way to diversify your portfolio is to invest in both standard and alternative assets. Alternative assets like real estate, promissory notes, and cryptocurrency can balance out the other assets and reduce investment risk.

Recently, cryptocurrencies have been experiencing a low, with Bitcoin’s value around $20,000 in September 2022. However, Bitcoin is designed in a way that makes its purchasing power increase over time. This is done through Bitcoin halving, which refers to the event where the number of units entering circulation is cut in half.

Bitcoin halving happens once every 210,000 blocks are added (which is approximately four years). This lessens the supply of Bitcoin, making mining more expensive and the coins more valuable. Historically, Bitcoin value has increased with each halving.

Investors may choose to invest in digital assets with a Crypto IRA with Checkbook Control. This type of account gives them real-time access to their retirement funds, so they can trade based on different events and market fluctuations.

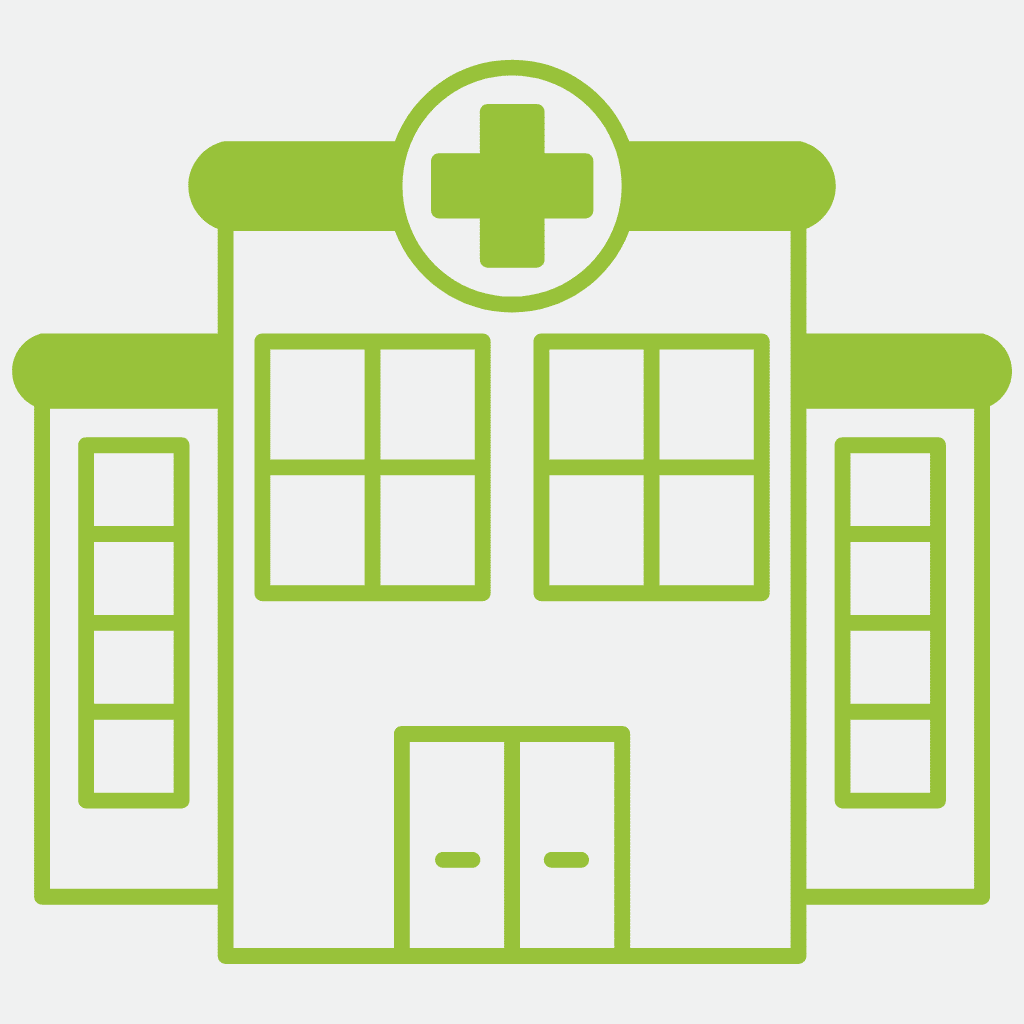

Almost every industry today relies on technology, which comes with the possibility of fraud and cyberattacks. The technology invented for cryptocurrency, known as blockchain, helps solve these issues and can increase the productivity and profitability of businesses.

Blockchain only records transactions once and does not allow anyone to alter a transaction after it has been recorded to the shared ledger. Participants can confirm transactions without the need for a central clearing authority, such as a third-party financial institution. It is also very secure, as no entity can reach the data without a cryptographic personal key.

Blockchain also uses smart contracts, which are a set of stored rules that can be executed automatically and programmed depending on different needs. These unique features of blockchain give it the versatility to be used throughout many different industries.

Digital currencies are created and stored electronically on the blockchain. Encryption techniques are used to control the creation of monetary units, verify the transfer of funds, and securely store data. Today, there are more than 10,000 cryptocurrency systems running on blockchain.

Blockchain can be used in healthcare to securely store and share clinical data among researchers and practitioners. This eliminates any inefficiencies such as billing errors, fraud, and cyberattacks. It also increases patients’ confidence that their records are safe from tampering or theft.

Blockchain can be used to track the movement of goods through the supply chain. This can lead to greater safety monitoring for products such as perishable goods and pharmaceuticals and can allow for faster recalls. It can also help suppliers and retailers communicate to ensure that they receive the supplies promised.

With the right algorithms, smart contracts may be used to replace legal contracts. Land titles can also be stored securely on the blockchain, making it impossible to be lost or stolen. In the future, it may also be able to trigger automatic payments of monthly rentals, taxes, and maintenance fees.

Cryptocurrency is a fairly new asset class that can diversify your retirement portfolio. Although it is very volatile and its future cannot be guaranteed, cryptocurrency has the potential to make substantial returns. And, when invested with a Self-Directed Crypto IRA, you can receive tax advantages.

Have questions about growing your retirement savings with cryptocurrency? Schedule a free phone call with one of Broad Financial’s Crypto IRA Specialists.

Note: It is recommended to speak with an advisor to discuss your financial strategy and determine if cryptocurrency is the right investment for you. Broad Financial does not provide legal, tax, or investment advice. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professional.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST