Go beyond the market by investing in real estate, small business, or other alternative assets. Take advantage and diversify in investments that make sense to you.

Many of Broad’s Self Directed IRA accounts offer full checkbook control. That means you can invest on your own without going through a custodian or paying custodian fees.

Many of Broad’s Self Directed IRA accounts offer full checkbook control. That means you can invest on your own without going through a custodian or paying custodian fees.

To see a comparison of Self-Directed IRA structures, please scroll below.

When researching Self-Directed IRAs, you’ll find that there are three basic fee structures:

In this model there is a low set-up fee, and the account holder pays a transaction fee for every action subsequently taken by the IRA.

The more assets that are held, the higher the annual fee.

There is a higher initial set-up fee, but there are virtually no fees afterwards.

Obviously everybody would like to choose the fee structure which affords them the greatest possible savings. However, even with that thought in mind, it’s not always so obvious which of the three fee structures will accomplish that. A number of factors can determine how much is eventually charged, and they include value of the invested assets, frequency of transactions, and degree of investor involvement. It’s best to run the numbers for your specific investment and see what makes the most sense.

To get a better grasp of the situation, let’s take a look at a standard self-directed IRA investment, and then figure out what it would cost in fees for each of the three models.

Donna switched jobs and took the opportunity to rollover her 401(k), wishing to find the best Self-Directed IRA for real estate. She wanted to use her retirement funds to purchase a two family house at the cost of $450,000 and then subsequently rent it out. Property management includes paying standard bills (electric, water, etc.), grounds maintenance (mowing and snow removal), and taking care of the occasional plumber call. Additionally (as with most properties), the house needed some initial rehab before being put on the rental market

In this scenario, the fees would break down as follows. (These dollar values are taken from the industry’s leading provider for each platform.) Take a look below at a Self-Directed IRA cost comparison:

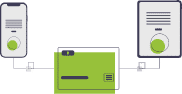

A Self Directed IRA gives retirement investors the means to choose their own assets. In a self-directed custodian account, a specialized IRA account is set up which can hold alternative assets. The account holder instructs the custodian whenever they would like an investment placed. The custodian makes the transaction and the IRA now owns a new asset.

Broad also offers accounts which offer full checkbook control. These accounts receive a LLC or Trust which can be used to open a dedicated checking account. Account holders invest just by writing a check. In this process the account holder can skip all of the custodian paperwork and fees.

Do you have questions about self-directed investing process? Speak with a Broad specialist to get answers.

Schedule a CallStart diversifying today with a Self- Directed IRA. You can apply online in just ten minutes.

Apply OnlineAddress:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200