If you are a one-person business operator, freelancer, or independent contractor, planning for retirement may seem like a daunting task since you are not provided with an employer sponsored plan. Luckily, self-employed individuals have several options to save for retirement and enjoy the same tax benefits. When deciding on a retirement account, the fee structure, choice of assets, and other plan details can make a big difference. This is especially true for a Self Directed Solo 401(k). Chances are, no retirement account will be as feature rich as a Self Directed Solo 401(k).

Most retirement plans are similar and share minor differences in three areas:

A Self Directed Solo 401(k) offers benefits in these areas, as well as a number of others. These benefits include:

Let’s dig a little deeper as to why each of these benefits matter.

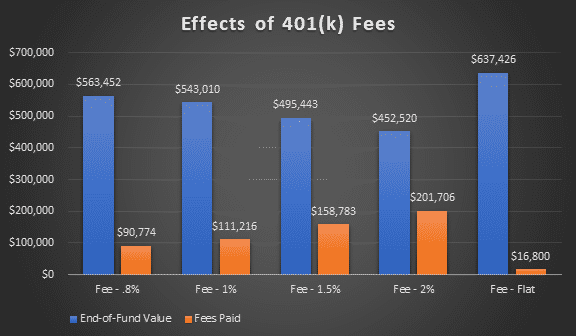

As mentioned above, the typical 401(k) plan charges about 1% per year. A CAP study from 2014 reported that a worker (depending on salary level) will pay between $138,336 - $340,147 in fees over the lifetime of the plan. That amount is high even when viewed by itself. It becomes especially concerning when you consider that those funds are not being invested. The net loss of future retirement income can be staggering.

In a Self Directed Solo 401(k), the fee structure is flat. The setup fee will be higher than a typical 401(k), but the annual fee will be consistently lower. Since the fee is not tied to the value of the funds invested, it won’t see any sharp growth.

Let’s take a look at how different fee rates can play out in real life. In this chart, we’ll be using these initial data points:

What we find here is that when fees are charged as a percentage of the fund, the numbers can quickly diverge. This is obviously true in terms of the amount of fees paid. However, it becomes even more real when looking at the end-of-fund value. In a standard 401(k), choosing a low 0.8% fee over a 2% fee will result in an additional $110,932 in profit. This difference becomes even more pronounced with the flat fees of a Self Directed Solo 401(k). The bottom line is that fee rates matter.

The stock market has always been the go-to place for retirement investing. Brokerages and online trading platforms have made it easy to sign up and have your investing carried out in a capable manner. The only problem with this system is diversification. Although you can diversify within the realm of stocks (and similar products) you cannot go beyond them. If you want to diversify with a wider asset spread or you’re passionate about a specific investment, you’ll need a different venue.

A Self Directed Solo 401(k) opens the doors to virtually any asset. There are very few limits on what a Self Directed Solo 401(k) can invest in, with the notable exceptions being collectibles and life insurance. The only major factor in asset choice is one of prohibited transactions. Your retirement account cannot make a transaction between you or a close relative.

Example: Richard works as a self-employed real estate agent. One day he sees a property being foreclosed on that would make an excellent investing opportunity. He calls his current IRA custodian – one of the major brokerages – but they tell him they cannot facilitate property. Richard decides to open a Self Directed Solo 401(k) and rolls over some of his retirement funds. He purchases the property at auction and pays with a check from his Solo 401(k) account.

The next step in Richard’s investment is to do some light rehab. He consults with his accountant who tells Richard that he cannot do the rehab himself. Richard is also informed that his son cannot do the rehab. Instead, Richard hires a trusted contractor with whom he has had positive interactions in the past.

In a Self Directed Solo 401(k) you get to manage your funds directly. Obviously, nobody cares as much about your money as you do. That added incentive will help ensure your account hits all opportunities for savings and profits. You can choose the best assets while also saving on management fees.

This is a feature unique to the Self Directed Solo 401(k) that you won’t find in other self-directed accounts. The IRS allows plan participants to take out a loan for any purpose. In a company setting, you must go through the plan administrator to take out the loan. In a Self Directed Solo 401(k) you can just write a check from the Solo 401(k) account to yourself.

This kind of loan is not free money. The proper paperwork needs to be completed and the loan must be paid back within five years. Payments are usually set up to be quarterly. Interest is also due, but there is no fixed rate. You can set a rate that would make sense if the loan was received from a third party. The interest is positive in this case as it goes right back to your retirement account.

A Self Directed Solo 401(k) loan has an upper cap. You can borrow up to half the account or $50,000 (whichever is less). The payments are simple as you can make out a check straight to the Solo 401(k) account. To figure out what your payment schedule will look like, you can run the numbers on the 401(k) loan calculator.

A Self Directed Solo 401(k) works with a Trust and a dedicated checking account. That means that you have full checkbook control. This differs from a self-directed custodial account where an investor works through the custodian. Custodial requirements commonly include filling out paperwork for every transaction. It can be a time-consuming process for otherwise simple actions.

In a Self Directed Solo 401(k), transactions are performed via its dedicated checkbook. Since the checking account is associated with the Trust, every check written is in essence a Solo 401(k) check. In the case of real estate, you can purchase a property or pay for maintenance just by writing a check. Even better, you don’t have to pay transaction fees for these actions.

A Self Directed Solo 401(k) allows account holders to contribute more than in a Self Directed IRA. For 2024, an account holder can contribute up to a total of $69,000. If the plan owner is over 50, that limit is raised to $76,500. In an IRA, the maximum contribution is $7,000, and $8,000 if the account holder is over 50. The Self Directed Solo 401(k)’s increased contribution limit can make a significant difference when building a nest egg for retirement.

The $69,000 cap is a combination of two different amounts. In a company 401(k), a contribution can be made by the employee in the form of a salary deferral. The company can also contribute matching funds. These funds can be tied to the employee’s salary or to the amount they contributed.

In a Self Directed Solo 401(k) both kinds of contributions can be made. It’s just in the case of a self-employed worker, they both come from the same source. IRS rules allow for a salary deferral up to $23,000. Then an additional contribution can be made in the value of 25% of net earnings. These two contributions together are capped at $69,000.

To figure out how much you can contribute to a Self Directed Solo 401(k), please visit the Solo 401(k) contribution calculator.

A Self Directed Solo 401(k) account was designed specifically for those with self-employed income. It was meant to give these workers the same retirement benefits that company employees receive. To achieve this goal, the IRS mandated a number of important qualifications. These are meant to keep the Self Directed Solo 401(k) for its intended users and not be abused as a tax loophole.

In order to be eligible for a Self Directed Solo 401(k), account holders must meet the following qualifications:

Self-employed workers can access enhanced retirement benefits in the form of a Self Directed Solo 401(k). The Solo 401(k) element gives them increased contribution levels. The self-directed element empowers them with full asset choice and hassle-free checkbook control. If a worker qualifies, a Self Directed Solo 401(k) offers a robust alternative to standard retirement accounts.

Still have questions about Self-Directed IRAs?

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST