Are you looking for a way to invest in alternative assets in real-time, without the added cost of transaction fees? If so, a Checkbook IRA from Broad Financial should be on your radar. With a Checkbook IRA, you can enjoy the power of checkbook control and invest in alternative assets directly, without the need for a custodian for everyday transactions. You’ll have the freedom to invest in what you want, when you want.

A Self-Directed IRA (SDIRA) is a retirement account that allows you to invest in alternative assets beyond Wall Street products. Any time you want to perform a transaction, you’ll fill out and submit a form authorizing your Self-Directed IRA custodian to send your IRA funds directly to your investment on your behalf.

On the other hand, a Checkbook IRA is a type of Self-Directed IRA that allows you to perform transactions relating to your investment on your time. With a Checkbook IRA, once you identify an alternative asset that interests you, you can simply write a check or send a wire from your Checkbook IRA’s designated checking account.

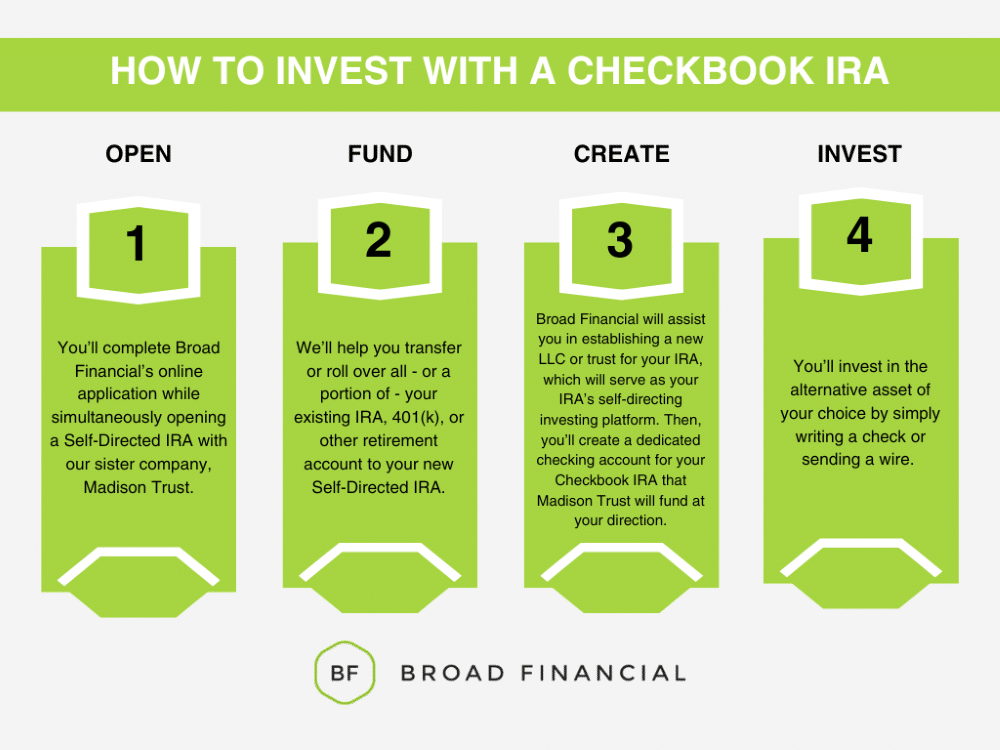

Broad is pleased to offer two types of Checkbook IRAs to meet the needs and preferences of various investors.

One option investors may consider is the IRA LLC. An IRA LLC provides the diversification of a Self-Directed IRA with the added benefit of real-time access to IRA funds. With this type of Checkbook IRA, you’ll set up a specialized LLC for your IRA that conforms to all relevant ERISA regulations, followed by a dedicated IRA LLC checking account.

The other option is an IRA Trust. Just like an IRA LLC, an IRA Trust allows you to access your IRA funds in real-time. However, an IRA Trust is set up by creating a trust for your IRA along with a designated IRA Trust checking account.

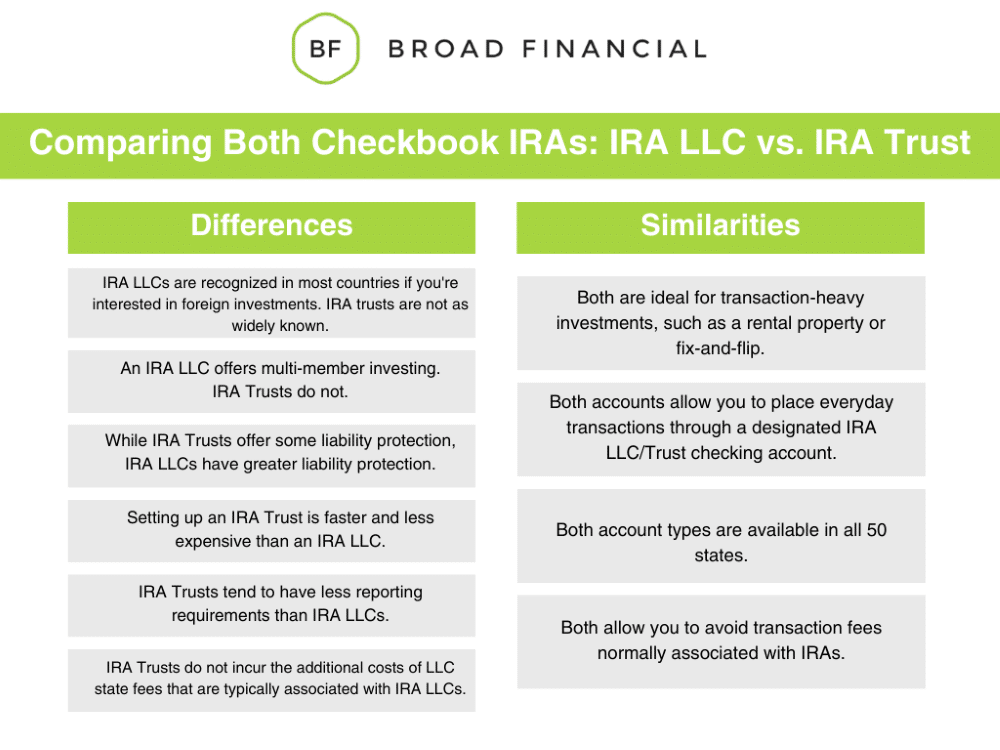

There are several similarities between IRA LLCs and IRA Trusts:

Several distinctions exist between IRA LLCs and IRA Trusts:

With Broad Financial’s Checkbook IRA, you’ll enjoy the 3 C’s. which include:

You gain direct control of all your investment decisions. There’s no need to fill out a form or wait for your Self-Directed IRA custodian to process your day-to-day investment transactions. You are truly in the driver’s seat of your self-directed investing!

Because you have the freedom to make your everyday transactions, you avoid the transaction fees that are normally associated with Self-Directed IRAs. In turn, you get to enjoy more money for your investments.

You may invest in just about any type of alternative asset you can think of with a Checkbook IRA. Some popular examples include real estate, cryptocurrencies, private placements, and promissory notes.

Schedule a free strategy session with a Broad Financial Self-Directed Directed IRA Specialist. We can answer your questions to help you determine which Checkbook IRA is right for you. Today’s the day for you to gain control of your investment ideas with one of Broad’s Checkbook IRAs!

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST