A Self-Directed IRA (SDIRA) is a powerful retirement vehicle that opens the doors to alternative assets, like real estate, private placements, and cryptocurrencies. With an SDIRA, you don't have to stick to investing in stocks, bonds, and mutual funds. You may invest in what you know and love.

If you’re exploring the idea of an SDIRA, you should know that it can own a specialized type Limited Liability Corporation or LLC to help you gain the power of checkbook control. Keep reading to learn how this works and why you may benefit from this setup.

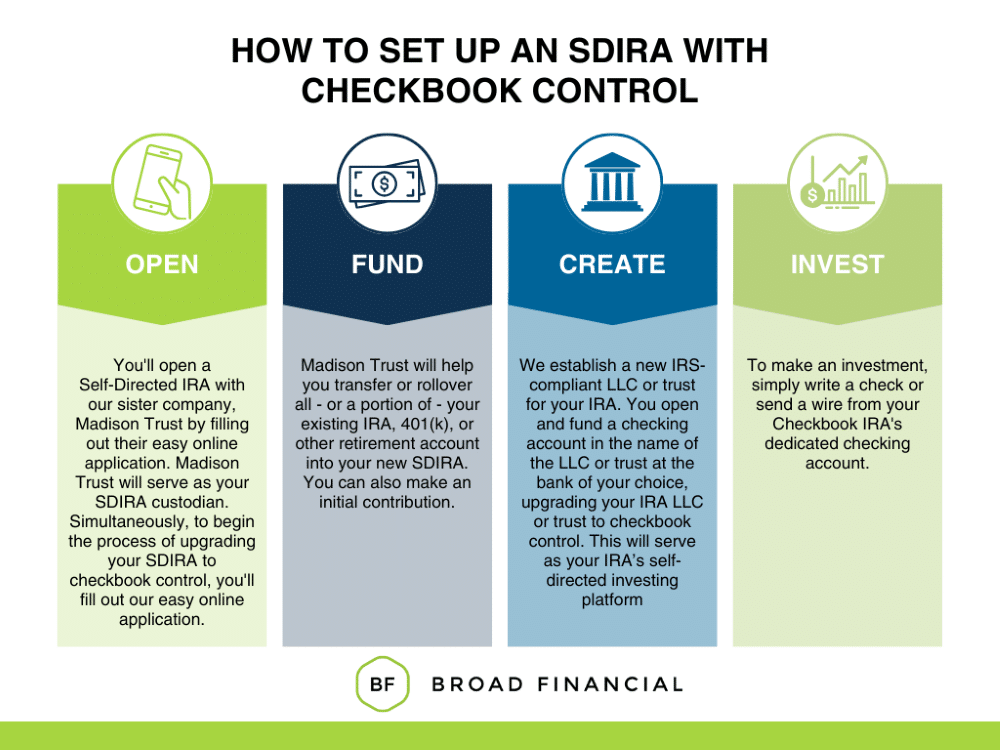

An SDIRA with Checkbook Control or Checkbook IRA is a type of Self-Directed IRA that gives you greater control and flexibility over your retirement savings. Once you open a Checkbook IRA, you can perform your everyday investment transactions without your custodian. All you have to do is establish an IRA LLC or an IRA Trust. If you go the LLC route, you’ll serve as its manager and enjoy the freedom to complete your everyday transactions on your own.

Unlike your classic SDIRA, a SDIRA with Checkbook Control, allows you to bypass your custodian. You, the account holder, can perform transactions on your own after you establish an IRA LLC or IRA Trust, followed by a dedicated checking account. Simply write a check or send a wire to make transactions in real-time.

The most noteworthy advantages of SDIRA with Checkbook Control include:

Since there's no custodian involved with your everyday transactions, you gain the capability to invest in real-time. Simply write a check or send a wire from your dedicated checking account any time you want to complete a transaction.

You can invest in a variety of alternative assets through a Checkbook IRA. A few examples include real estate, private placements, promissory notes, and private placements.

Because you're able to make your everyday transactions on your time with a Checkbook IRA, you can avoid transaction fees while potentially maximizing your earnings.

While Madison Trust, our sister company and Self-Directed IRA custodian will administer your Checkbook IRA, you’ll have complete control of your investment decisions. Your retirement investing will be in your own hands.

A Checkbook IRA allows you to invest in an array of alternative assets, such as:

It couldn’t be easier to set up a Checkbook IRA! Here’s what the simple, four-step process entails:

If you’re interested in investing for retirement with a Checkbook Control IRA from Broad Financial can be the ultimate option. To get started or learn more, we encourage you to contact us today.

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST