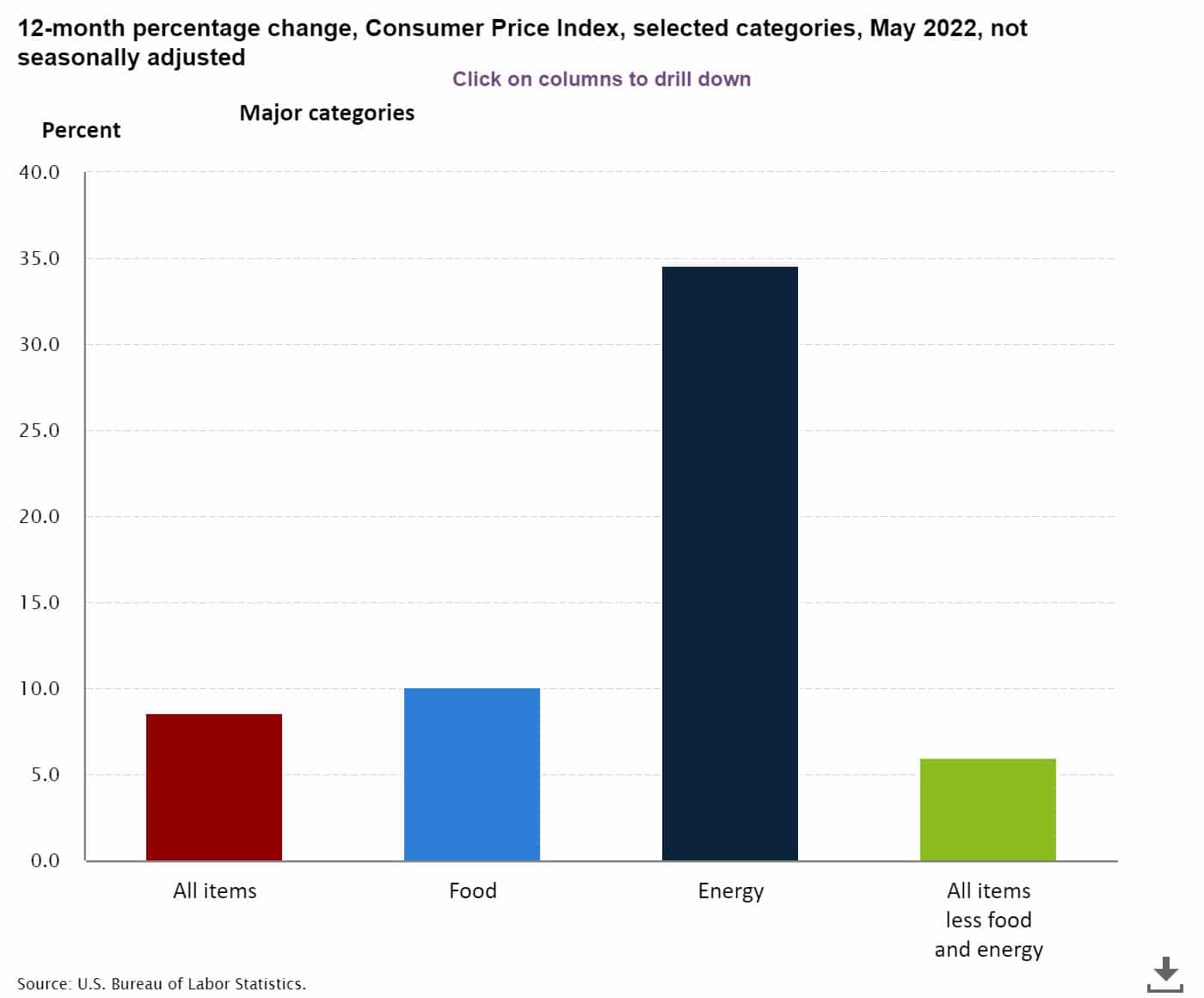

It is no secret that the inflation rate has been soaring recently, accelerating to 8.6% in May 2022 (the highest rate since December 1981), according to the U.S. Bureau of Labor Statistics. Americans have seen an increase in the price of energy (gasoline, electricity, natural gas), food, shelter, airline fares, automobiles, and more. In order to try to curb inflation, the Federal Reserve raised its benchmark interest rate by a 0.75 percentage point. This is the biggest increase since 1994.

Source: U.S. Bureau of Labor Statistics https://www.bls.gov/cpi/

When a substantial increase in interest rate happens, it is only natural to wonder how this change might affect your current wallet as well as your retirement account. Here’s what you need to know.

In general, the Fed raises interest rates to manage rising inflation. Inflation is the rate at which prices of goods and services increase over time. This results in a decrease in the purchasing power of currency. A common calculation of the inflation rate is looking at the percentage change from a year ago. For example, if the price index is 3% higher than last year, this would indicate an inflation rate of 3%.

The Federal Reserve (aka the Fed) aims for inflation of 2 percent over the long run to reach the economy’s potential of maximum employment and price stability. This means everyone who wants a job in the U.S. economy can find one and the prices for goods and services remain relatively stable. The Fed's goal is for inflation to “remain low and stable” so households and businesses can “make sound decisions regarding savings, borrowing, and investment, which contributes to a well-functioning economy.”

By increasing the interest rate, the Fed hopes to discourage consumers from making large purchases and increase their savings instead. When the interest rate increases, it becomes more expensive to borrow money. So, consumers are less likely to purchase large items that they would normally finance such as houses, cars, and new technology. Businesses are also less likely to borrow money for new projects and expansions.

Consumers are more encouraged to save because of the higher cost of borrowing as well as the higher prices of goods. This results in a decrease in demand, in hopes to achieve lower and more stable prices.

People may also feel more encouraged to save because when interest rates are high, they can earn more by saving at this time. This leads to more money left in the bank. Overall, by increasing the interest rate, the Fed is hoping to reduce economic activity and lower inflation.

Generally, borrowing money becomes more expensive when the Fed increases the interest rate. This directly impacts and raises the interest on credit card debt, auto loans, personal loans, mortgage rates, and more. This also affects savers since they will be earning more on the money saved.

In addition, when the Fed raises the interest rate, it causes some concern about it causing the United States to go into a recession. Recessions often occur when there is an increase in unemployment and high inflation.

However, economists and policymakers have seen conflicting signals. So far, the U.S. employment rate remains low and consumers have continued to spend. Investors should be prepared for more volatility.

Unfortunately, retirement plans are vulnerable to rising interest rates. Depending on the types of investments you hold, the impact on your retirement plan may differ.

If you are investing in standard assets (stocks, bonds, and mutual funds), you could potentially see your retirement savings reduce in value. This is because these types of investments are affected by the interest rate increase.

However, if you are invested in alternative assets, such as gold, promissory notes, etc., that perform inversely to standard assets your retirement portfolio will not be as affected.

One way to ensure you make the most out of your retirement plan is to have a diversified portfolio. Standard assets and alternative assets can balance each other out in times of economic uncertainty.

Depending on what assets you are invested in, the increase in interest rate will have a different effect on your retirement.

Stocks - Rising interest rates aim to slow economic activity to keep prices from growing any further. When consumers spend less when interest rates rise, it results in lower profits for companies. When companies see a decrease in revenue, this typically causes stock prices to decline. The companies that depend on a customer’s ability to borrow money (such as automobile manufacturers, home builders, etc.) will be especially impacted by these changes.

Bonds - In terms of bonds, the interest rate hike can reduce their value. If you plan on holding your bond to maturity, this should not affect you. However, if you need it before maturity, you will receive it at a lower price. This is because if the interest rate you bought the bond at is lower than the current interest rate on the market, you will have to sell it at a discount to match the new bonds just issued at the higher rate.

Real Estate, Promissory Notes, Precious Metals - On the contrary, investors who purchase alternative assets like real estate, promissory notes, or precious metals may see more stability at this time. For example, consider utilizing a Self Directed IRA to invest in rental property to hedge against inflation. The rental income you receive can keep pace with inflation and be raised based on the market.

Another example is to invest in precious metals like gold or silver with a Self Directed IRA. Precious metals often have an inverse relationship with the stock market. When the stock market decreases, typically the value of gold increases (and vice versa).

Recent economic conditions have shown that having a balanced portfolio with both types of investments (standard assets and alternative assets) is critical.

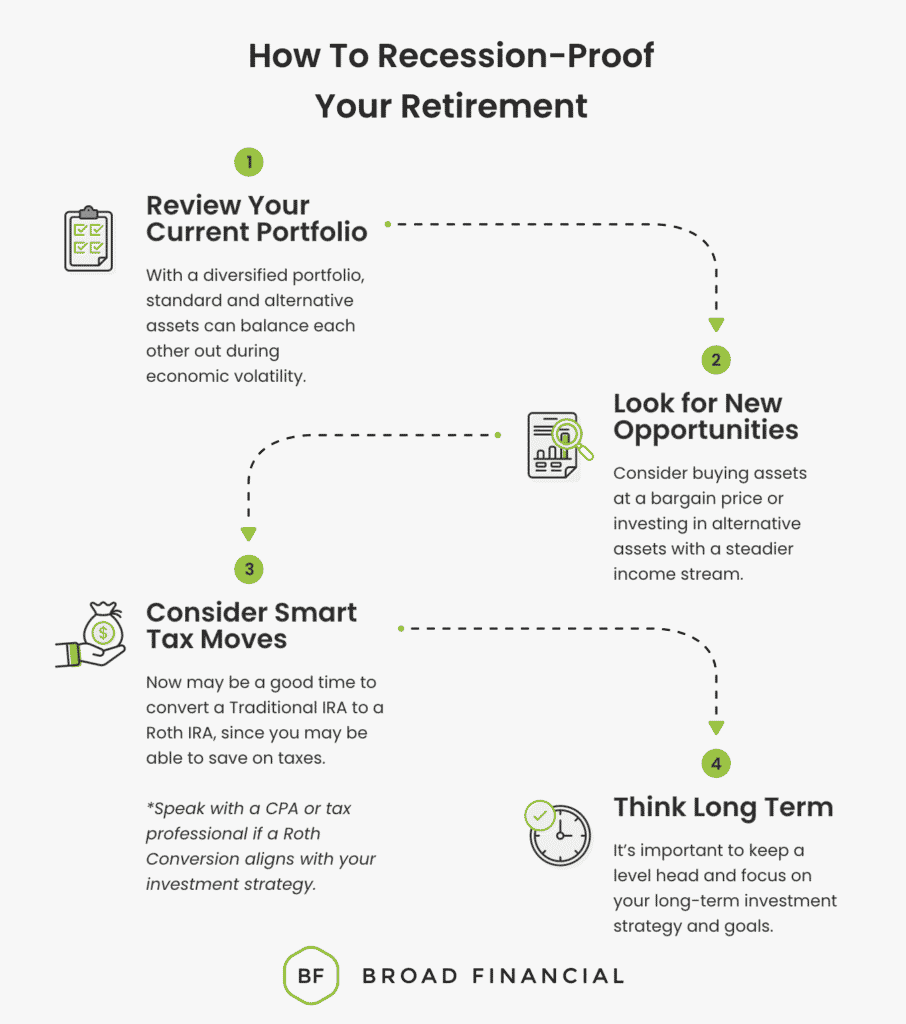

When something like an interest rate increase occurs, it’s a good idea to keep an eye on how it impacts your retirement savings. However, it is important not to react too quickly or dramatically. Before making any changes, be sure to review your goals and strategy with a financial advisor. Here are a few ways to stay on track with your retirement plan.

Take inventory of the types of investments that make up your retirement portfolio. Almost all financial advisors agree that a diversified portfolio is important. A truly diversified portfolio includes a mix of standard assets (stocks, bonds, and mutual funds) as well as alternative assets (real estate, precious metals, promissory notes, etc.). When you invest in assets that balance each other out, your portfolio can weather all types of economic conditions.

As with any situation, you can choose to look at it with a glass-half-empty or a glass-half-full mindset. Investors who stay positive look for ways they can benefit.

For example, if time is on your side consider strategically acquiring certain assets that may be experiencing a low right now. You may be able to get them at a bargain and achieve greater growth than if you were to buy them at a higher price.

Another opportunity that many investors are unaware of is the ability to invest in alternative assets with retirement funds. Self Directed IRAs allow you to take advantage of your knowledge and expertise so you can invest in almost any asset you believe in. Consider balancing your portfolio with assets that have a steadier income stream, such as real estate.

You can also consider the opportunity to use your Self Directed IRA funds to invest in promissory notes or loans. Since borrowing becomes more expensive with the rising interest rate, this is a great opportunity for the lender. As a lender, you can charge a higher interest rate to the borrowers and receive a greater return on your investment.

Another opportunity present during this market downturn is that it might be a good time to convert your Traditional IRA to a Roth IRA.

With a Traditional IRA, you can contribute pre-tax funds for retirement but must pay the taxes when you withdraw the funds. On the other hand, when you contribute funds to a Roth IRA you pay the taxes upfront and can enjoy tax-free growth and withdrawals during retirement. In certain scenarios, such as the current economic downturn, it may be worth considering converting Traditional IRA funds to Roth IRA funds (aka perform a Roth Conversion) to save on the taxes paid on the conversion.

For example, if you originally have $150,000 in your Traditional IRA, but the value recently decreased to $110,000 when the market dropped it may make sense to perform a Roth Conversion. By converting now, you would be saving money since you will only pay taxes on the $110,000, as opposed to $150,000.

Also, if the assets in your portfolio recover, you will be able to enjoy the tax-free gains in your new Roth IRA. It is highly recommended to speak with a tax professional or CPA to ensure this aligns with your investment goals and strategy.

Before doing a Roth Conversion talk to your financial advisors and consider the following:

It can be stressful when interest rates increase, causing a change in market values and your retirement portfolio’s value. However, it is important to keep a level head and focus on your long-term strategy and goals.

Interest rates rise and fall and making big changes because of them is often not a good move. It is important to stay calm. Making a rash decision can cost you in the long run. A diversified and often rebalanced portfolio can help your retirement portfolio stay on track during economic volatility.

Are you interested in balancing your portfolio by investing in alternative assets, but are not sure where to start? Broad Financial’s Self Directed IRA with Checkbook Control allows you to invest in almost any IRS-approved asset. Here are the steps to invest in an alternative asset at Broad Financial.

It’s that simple! Now you are equipped with a way to overcome the financial rollercoaster.

The Fed’s decision to raise interest rates was made to help curb inflation and get the economy back on track. This change is causing concern to some about the rising cost of borrowing, the possibility of a recession, and the effect on retirement savings. However, it is essential to keep a level head.

Taking actions such as reviewing your portfolio, looking for new investment opportunities, considering smart tax moves, and thinking long-term can be beneficial. A diversified portfolio is crucial to keep your retirement account on track to achieve your investment goals.

Do you have questions about investing in alternative assets?

Speak with a friendly and knowledgeable Broad Financial Self Directed IRA Specialist to get your questions answered.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST