Self-Directed IRA LLCs (Limited Liability Companies) have become increasingly popular due to their flexibility, limited liability protection, and tax advantages. But along with this increased power and control, comes the responsibility to understand when taxes are due, file the proper IRS forms, and report the fair market value of your account. You may be wondering, “Does a Self-Directed IRA LLC file a tax return?” In this article we will discuss the Self-Directed IRA LLC tax filing responsibilities, what tax forms are required for an IRA LLC, and more so you can be prepared this tax season.

A Self-Directed IRA LLC is a powerful retirement account that gives you the opportunity to invest in real estate, cryptocurrency, and other alternative assets in real time. The structure of a Self-Directed IRA LLC offers the limited liability protection of a corporation and the single-level taxation of a partnership.

One of the unique characteristics of an LLC is that it is considered a “pass-through” entity for federal (and typically for state) income tax purposes. This means all taxable gains and losses are passed through to the LLC’s owner, which is the Self-Directed IRA. The Self-Directed IRA, not the LLC itself, is responsible for paying any applicable taxes.

In general, the LLC does not have to file an annual tax return. This is because the owner of the LLC is the tax-deferred (Traditional IRA) or tax-free (Roth IRA) Self-Directed IRA.

However, certain situations may cause your Self-Directed IRA LLC to be subject to taxes. Please note, a single-member LLC is treated as a sole proprietorship and a multi-member LLC is treated as a partnership for tax purposes. In addition, the multi-member IRA LLC is required to file a tax return even if no taxes are due.

Your Self-Directed IRA LLC may be subject to taxes in the following scenarios:

UBIT (Unrelated Business Income Tax) is a tax that is due if your IRA invests in an asset that earns active income from the sale of products or services that is not related to the IRA’s tax-exempt purpose. For example, certain real estate investments such as construction, development, short-term fix and flips typically incur UBIT. Also, investments that generate income from an active trade or business such as a store that sells goods and services are typically subject to UBIT.

Note: real estate income (without debt leverage), interest income, capital gain income, and dividend income are all exempt from UBIT.

When an IRA receives income from an investment obtained with borrowed funds, known as UDFI (Unrelated Debt Financed Income), then the IRA is subject to taxes on the debt-financed portion of the investment.

For example, assume a rental property is on the market for $500,000. A Self-Directed IRA LLC account holder decides to invest $400,000 in the property and use a non-recourse loan to help finance the additional $100,000. In this case, 20% of the net income generated from the property will be subject to UBIT.

If UBIT and UDFI occur, then IRS Form 990-T must be filed. All taxes are paid by the Self-Directed IRA, not your personal funds.

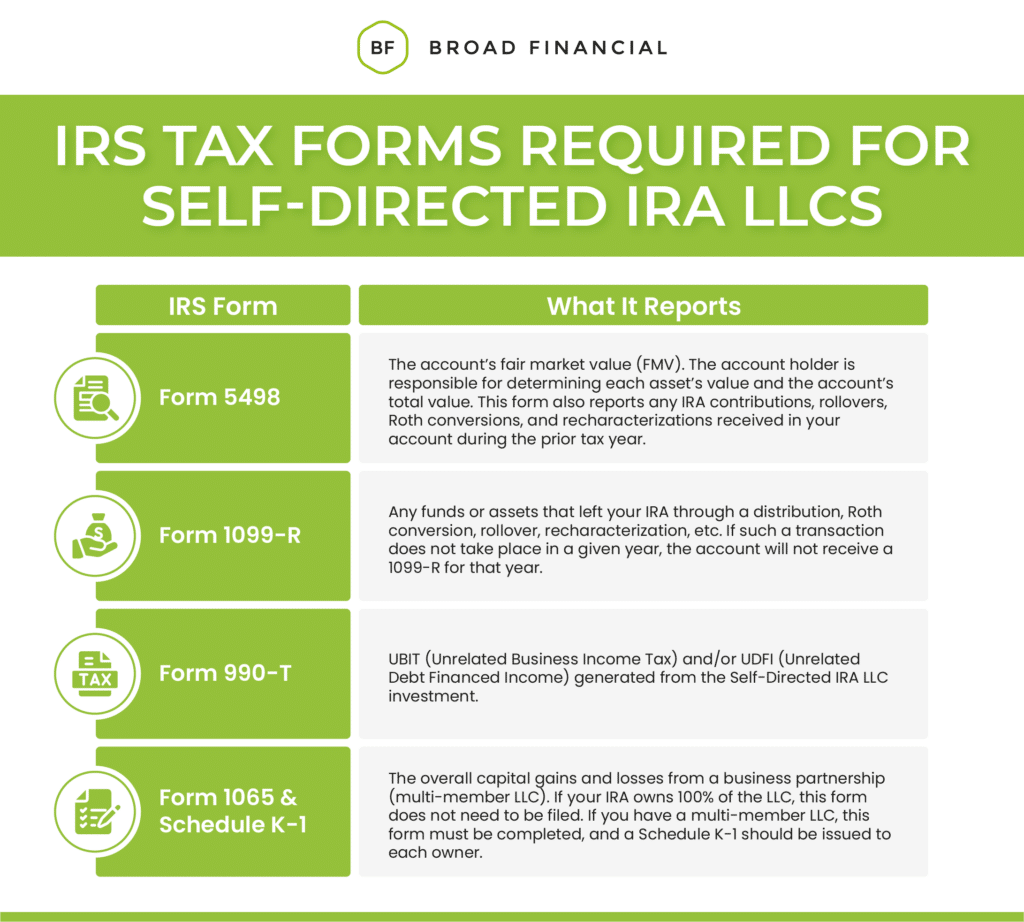

Although most Self-Directed IRA LLCs do not have tax filing requirements, the IRS requires the completion of a few annual forms:

As a Self-Directed IRA LLC investor, you must be aware of your tax reporting responsibilities. Although Self-Directed IRA LLCs are typically not responsible for any annual tax filing, ensure you are aware of the scenarios that may cause your LLC to be subject to tax and the annual IRS forms that must be filed.

Do you have more questions regarding Self-Directed IRA LLC tax filing? Book a free discovery call with a Self-Directed IRA LLC Specialist today to get your questions answered.

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST