Cryptocurrency continues to be a popular investment, as investors seek to buy assets beyond the stock market and keep up with the advancing blockchain technology. Cryptocurrency also piques investors’ interest due to its potential for substantial returns and ability to diversify their investment portfolio. The savviest investors know that the most tax-advantaged way to invest in cryptocurrency is with retirement funds in a Self-Directed Crypto IRA LLC.

Typically, standard IRAs and 401(k)s only offer investments available on Wall Street such as stocks, bonds, and mutual funds. With a Self-Directed Crypto IRA, account holders can further diversify their portfolio with cryptocurrency, real estate, private equity, and beyond. Account holders can choose between opening a Traditional, Roth, SEP, or SIMPLE account.

Taking it a step further, establishing an LLC for your Self-Directed Crypto IRA gives you the most flexibility at a lower cost. Let’s explore what an IRA LLC is and how to invest in cryptocurrency with a Self-Directed Crypto IRA.

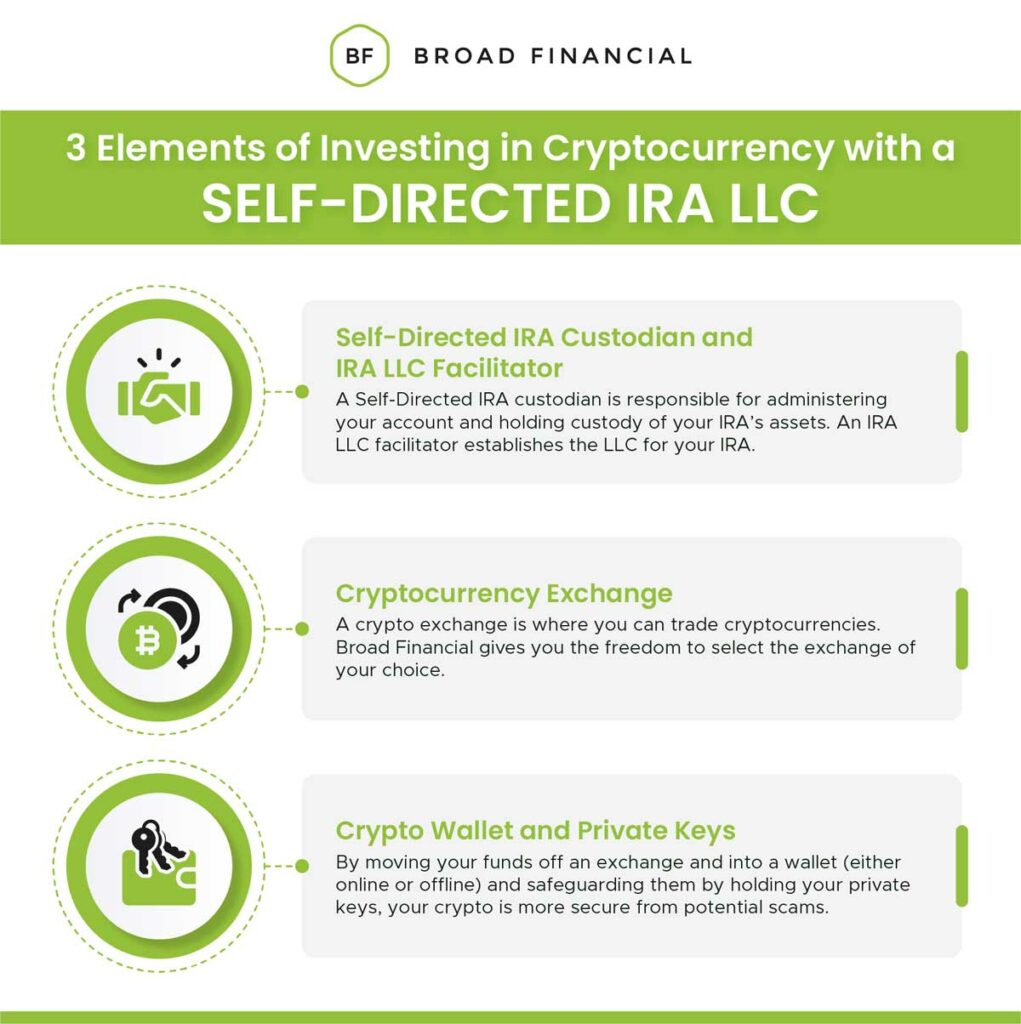

An IRA LLC (also known as a Self-Directed IRA LLC, Self-Directed IRA with Checkbook Control, Checkbook IRA, and Crypto IRA) is an IRS-compliant self-directed retirement account that allows you to invest in cryptocurrency and other alternative assets in real time. Typically, the account holder serves as the non-compensated manager of the LLC and the Self-Directed IRA (not the account holder) owns 100% of the LLC.

Through a designated IRA LLC checking account, you have the power to invest in the asset of your choice by simply writing a check or sending a wire. This eliminates both custodian paperwork and transaction fees.

When investing in cryptocurrency with an IRA LLC there are three components you’ll want to keep in mind:

Cryptocurrency investors use the acronym HODL, or “hold on for dear life”, as encouragement not to sell when prices fall in hopes that the price will rise in the future. In recent years Bitcoin has been very volatile: doubling in price in 2021 with a high of about $68,000 in November, dropping below $36,000 in January 2022, spiking in March 2022 to about $50,000, and now hovering around $20,000 in recent months.

First, you’ll complete Broad Financial’s easy online application. Simultaneously, you’ll open a new Self-Directed IRA with our sister company, Madison Trust. To fund your Self-Directed IRA, you’ll transfer or rollover funds from an existing retirement account, such as an IRA or 401(k), or make an initial contribution.

Next, Broad Financial will create a specialized, IRS-compliant LLC for your IRA and take care of the paperwork.

Once your specialized LLC is created, you will open a checking account in the name of your LLC at the bank of your choice and instruct Madison Trust to send your IRA funds directly to the IRA LLC checking account.

Finally, you can start investing with the power of checkbook control by simply writing a check or sending a wire from your new LLC checking account.

Together with our sister company, we bring the entity creation, support, and custody of your checkbook control Self-Directed IRA together for a seamless experience. We provide everything you need to start investing your way.

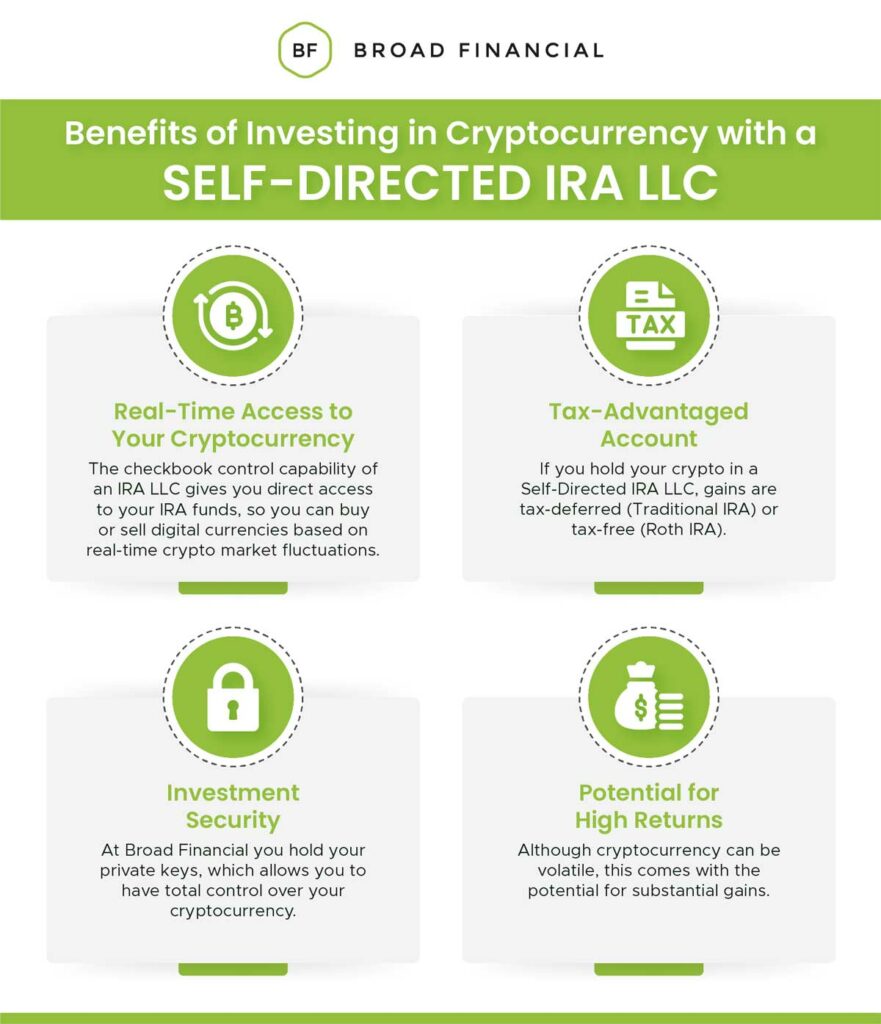

An IRA LLC gives you the opportunity to diversify your portfolio in real time with alternative assets that are usually not available in a standard IRA.

You get to freely trade cryptocurrency without paying transaction fees or capital gains tax at the point of sale.

With a Broad Financial Crypto IRA LLC you hold the private keys, meaning you store and trade on your time with no limitations from exchanges and have increased security from potential scams such as the FTX scandal.

Broad Specialists have experience with an extensive range of asset classes and can answer any questions you have about the self-directed investing process.

A Self-Directed Crypto IRA LLC is a unique vehicle that can be utilized to invest in cryptocurrency with retirement funds. Once the IRA LLC is established, transactions can be made at any time and with no transaction fees. Broad Financial’s IRA LLC puts you in control of your cryptocurrency investments by letting you hold the private keys and gives you a seamless way to diversify your retirement portfolio.

Are you interested in investing in cryptocurrency with your retirement funds? Speak with a Broad Financial Specialist to get started today.

Disclaimer: As with any investment, cryptocurrency involves risk. Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with the appropriate tax, legal, and financial professional to ensure this investment is right for you.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST