On November 11, 2022, Sam Bankman-Fried stepped down as CEO of FTX and the companies he oversaw filed for Chapter 11 bankruptcy. To put it simply, billions of dollars were lost and could not be repaid to its investors. Currently, FTX is facing investigations by the Securities and Exchange Commission and the Department of Justice.

So, what is FTX? What caused FTX to collapse? How does this affect you, as a cryptocurrency investor? How can you gain control of your crypto investments?

FTX is a digital currency exchange, which is a platform where users can buy and sell Bitcoin, Ethereum, and other leading cryptocurrencies. FTX was founded in 2019 by Sam Bankman-Fried. The exchange grew in popularity to become the third-largest exchange by volume, with sponsorships including Miami Heat’s basketball stadium (FTX Arena), a partnership with Major League Baseball, and endorsements from celebrities like Tom Brady and Larry David.

Many relate FTX’s collapse to 19th century bank runs, which is when large groups of customers simultaneously withdrew their deposits from a bank based on fears that it will fail. Public concern about FTX began in November 2022 when the company’s balance sheet was leaked and a CoinDesk article stated that FTX’s partner firm, Alameda Research, had a significant portion of its assets in FTX’s invented token, FTT.

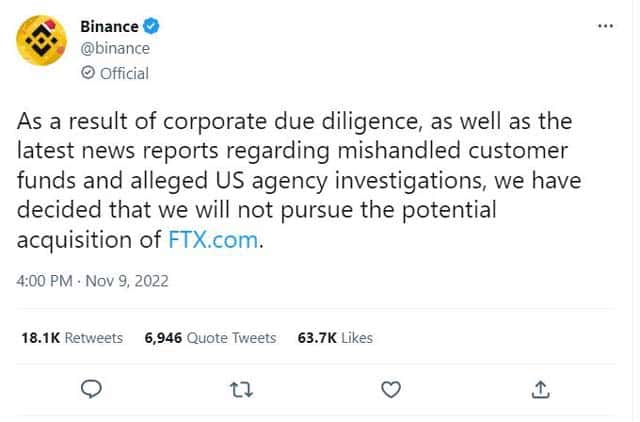

After this realization, rival exchange Binance’s CEO Changpeng Zhao announced that the company will sell all its FTT token holdings. This caused the price of FTT to drop sharply and the number of customer withdrawals from FTX to spike. FTX was unable to meet the demand for customer withdrawals.

At first, Binance was willing to acquire FTX to ensure its clients could recover their assets. However, the company quickly withdrew its offer due to FTX’s “mishandling of customer funds and alleged U.S. agency investigations” (Binance, 2022). There are allegations that FTX loaned at least $10 billion of its customer’s funds to Alameda Research to fund risky bets. Binance’s decision not to pursue the acquisition of FTX has led FTX investors scrambling to recover their assets and ultimately to the company’s bankruptcy.

The collapse of FTX has shaken some investors' faith in cryptocurrency and the economy, with some investors even believing that the “sky is falling”.

In addition to many FTX investors having a reported $0 wallet balance, other cryptocurrency companies exposed to FTX, like BlockFi and Genesis, lost value as well. Institutions including Sequoia Capital and the celebrities who endorsed FTX are also financially affected.

This situation highlights the benefit of moving your cryptocurrency assets out of someone else’s hands and gaining control by holding your private keys.

Many beginner investors tend to buy crypto on an exchange. However, when crypto is bought this way, the funds go to your wallet on the exchange platform, trusting them to hold and control your funds. The risk is that if the exchange pauses withdrawals, as FTX did, users cannot access their crypto. And even worse, if the exchange collapses or is the victim of a cyber-attack, all your holdings may be lost.

There is a saying in the cryptocurrency world, “not your keys, not your crypto”. This is the belief that you cannot be certain of your crypto holdings unless they are stored in a wallet in which you hold the private keys.

A private key is a randomly generated number with hundreds of digits that only you have access to. To simplify it for users, private keys are generally represented as a long passphrase. Private keys allow you to gain complete control over your crypto assets, so you can store and trade on your time with no limitations from exchanges.

By moving your funds off an exchange and into a wallet (either connected to the internet or offline) and safeguarded by your private keys, your crypto is more secure from potential scams.

Broad Financial provides you with the unique opportunity to use your retirement funds to invest in any cryptocurrency while holding the private keys. We establish the legal vehicle, either an IRA LLC or an IRA Trust, so you can invest your Self-Directed Checkbook IRA money into cryptocurrency or other alternative asset of your choice. Here are some advantages of investing in cryptocurrency with Broad Financial:

FTX’s collapse disrupted the cryptocurrency industry, with many of their investors losing assets and others concerned about their assets’ security. This situation heightened the significance of holding your private keys to ensure the cryptocurrency is in your control.

At Broad Financial, you can hold your private keys and enjoy the tax benefits of a Self-Directed Checkbook IRA. It is recommended to conduct thorough due diligence before investing in cryptocurrency.

Do you want to learn more about investing in cryptocurrency in a tax-advantaged account? Speak with a Broad Financial Specialist to get started today.

Disclaimer – Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST