Are you looking to diversify your retirement portfolio by stepping into the world of real estate? Rolling over your 401(k) into a Self-Directed IRA (SDIRA) can open up exciting opportunities to hold alternative assets such as real estate in a tax-advantaged retirement account. You can even take it a step further by opening a type of Self-Directed IRA called a Checkbook IRA, where Broad Financial excels in streamlining the process of setting up your account to provide more flexibility and control than you ever thought possible.

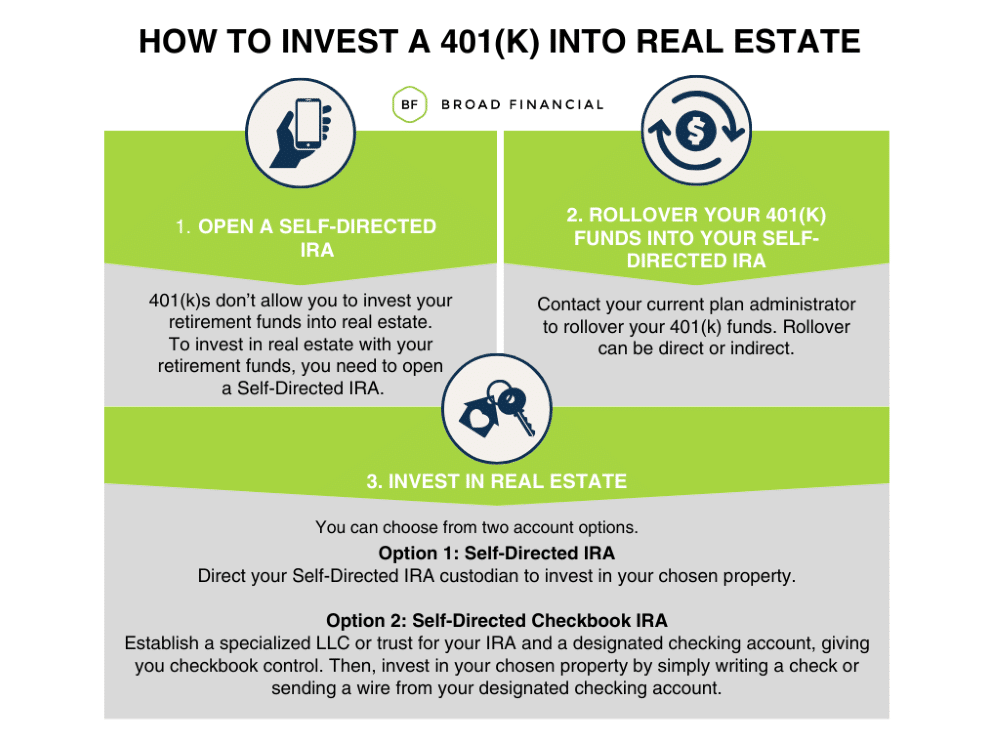

401(k)s don’t allow you to invest your retirement funds into real estate. Self-Directed IRAs, however, do. So, if you’re looking to invest your retirement funds into real estate, you can start by opening a Self-Directed IRA and then rolling over all or a portion of the funds in your 401(k) to your newly opened Self-Directed IRA.

A direct rollover occurs when your funds are transferred directly from your existing retirement account into a Self-Directed IRA. You will initiate your rollover with your current plan administrator and complete the required paperwork to roll over your funds to your new SDIRA custodian, thus funding your new Self-Directed IRA. Then, you’re ready to invest.

The Self-Directed IRA stands out as a powerful vehicle for investors looking to expand their retirement investing horizons beyond the usual stocks, bonds, and mutual funds. This flexibility is a game-changer, especially for those interested in including real estate as part of their retirement investing strategy.

The benefits of an SDIRA for real estate investing are multifaceted. First, it provides the opportunity to invest in a tangible asset, which can be more reassuring compared to intangible securities. Real estate investments within an SDIRA can yield rental income and can generally appreciate over time, contributing to a potentially more robust retirement fund. Additionally, the tax benefits associated with SDIRAs, including tax-deferred or tax-free growth of investments, apply to real estate held within the account. This can significantly enhance the overall returns from these investments when compared to similar investments outside of an IRA.

With a Self-Directed IRA, you can invest in a variety of property types, including rental and vacation properties, commercial real estate, real estate notes, private real estate investment trusts (REITs), tax liens and deeds, developed and undeveloped land, and more. You will list your IRA as the buyer on all paperwork when purchasing a property. Transactions are completed at your direction, by your Self-Directed IRA custodian, using your SDIRA funds.

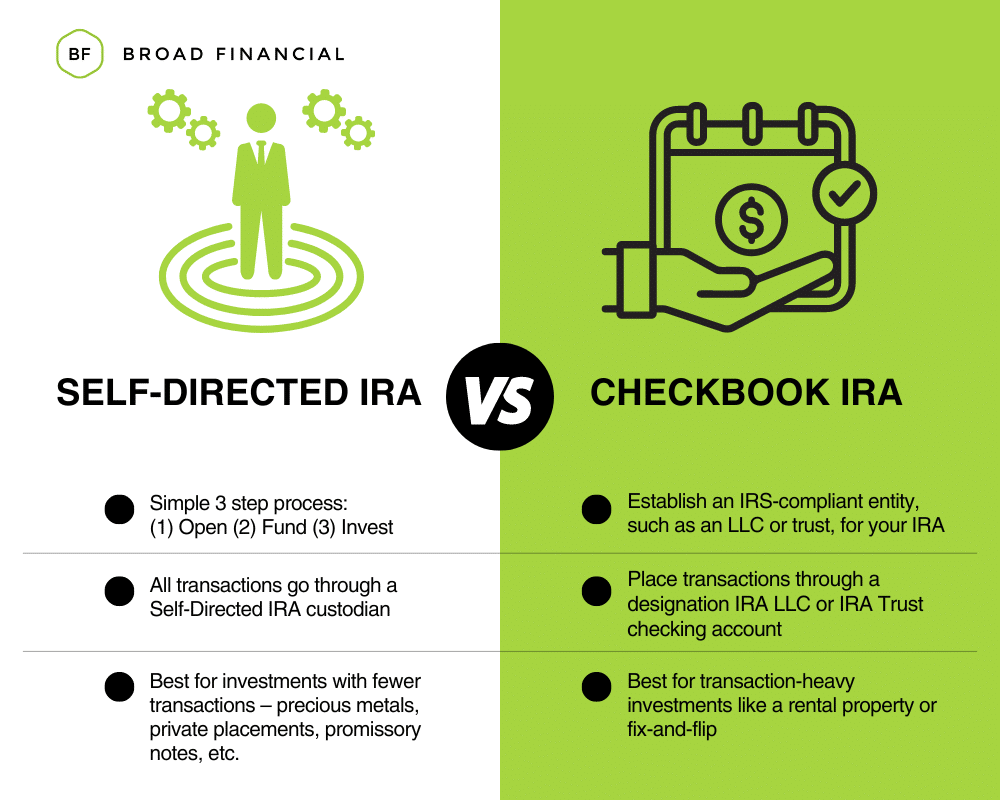

Broad Financial's Checkbook IRA takes the concept of a Self-Directed IRA a step further. This innovative product is particularly ideal for transaction-heavy investments, such as rental properties.

Our Checkbook IRA allows investors direct control of their everyday investment transactions, akin to writing a check, rather than going through a Self-Directed IRA custodian for each transaction. This structure offers unparalleled freedom in managing investments, providing a more efficient and flexible way to handle real estate transactions. We also refer to it as granting “checkbook control.”

To give you checkbook control of your SDIRA, Broad Financial will establish an LLC or trust for your IRA. Typically, an IRA Trust is the faster and more cost-effective option. However, an IRA LLC may be the better choice if you’re planning on purchasing real estate with non-recourse loans, buying property in a state that makes property insurance difficult for a trust to obtain, or considering multi-member investing. An LLC also provides more liability protection than a trust. Once your entity of choice is set up, you will then open a dedicated checking account for your IRA, at which point you will instruct your custodian to move funds from your IRA to your checking account. Then, you’ll be able to simply write a check or send a wire from the checking account for your designated IRA transactions.

Broad Financial offers expert guidance in setting up and managing a Checkbook IRA. Our team assists clients in understanding the nuances of this investment tool and provides guidance during the transition from a 401(k) plan to a Self-Directed IRA and then a Checkbook IRA. Are you ready to explore the expansive world of real estate investments to potentially grow your retirement savings? Schedule a Checkbook IRA discovery call with Broad Financial today!

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST