Are you looking to diversify your retirement portfolio beyond Wall Street? You can do so with Broad Financial’s Self-Directed IRA! With a standard IRA, you typically have to stick investing in Wall Street products, like stocks, bonds, and mutual funds. A Self-Directed IRA, however, works a lot like a standard IRA but opens the doors to investing in alternative assets. These investments can give you the chance to diversify your retirement portfolio, hedge against inflation, and potentially yield high returns. Let’s dive deeper into five of the most popular alternative assets among Self-Directed IRA investors.

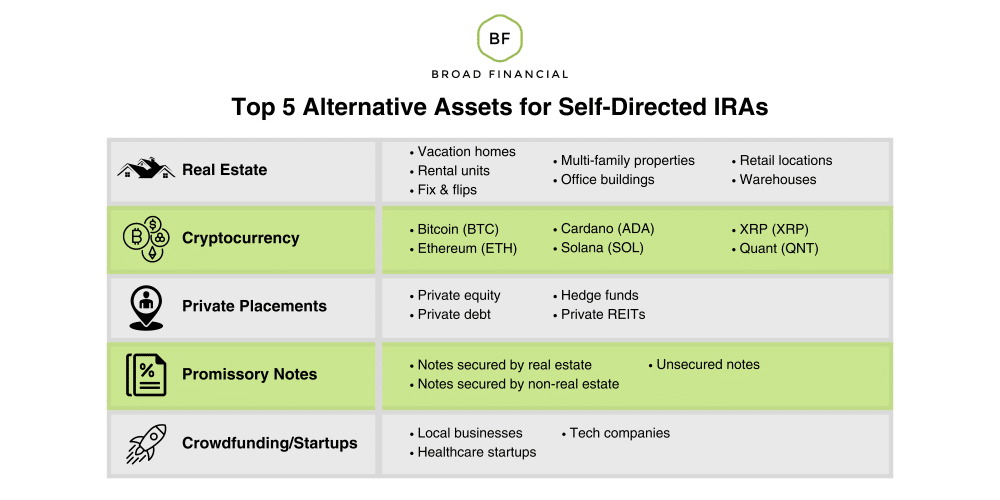

One of the most popular assets among Self-Directed IRA investors is Real Estate. Real Estate allows individuals to invest in something that’s tangible and typically appreciates in value over time. With a Self-Directed IRA, you can invest in a variety of valuable real estate opportunities, including:

Additionally, your Self-DIrected IRA can take your retirement investing into the digital age; you can use your Broad Financial Self-Directed IRA to invest in just about any cryptocurrency, including but not limited to:

Private placements is a general "catch-all" term for private businesses, private equity, hedge funds, etc. By investing in the private placement of your choosing through your Self-Directed IRA, you can enjoy investing in a private venture that you know and believe in. Some examples include:

For typically predictable, stable returns, you can invest in a number of promissory notes with your Self-Directed IRA. These include:

With a Self-Directed IRA, you can dip your feet into investing in startups and crowdfunding opportunities with high growth potential, such as:

When it comes to a Self-Directed IRA, the sky is truly the limit. While the investments mentioned above are very popular, there are a variety of other opportunities you may want to explore, including:

The right investment for you may depend on factors like your unique knowledge and interests as well as your long-term retirement goals. A Self-Directed IRA Specialist from Broad Financial can answer any questions you may have.

It couldn’t be easier to invest in alternative assets through a Self-Directed IRA. Broad Financial's Self-Directed IRA simplifies alternative investing even further as it upgrades you to the power of checkbook control. Here’s what you can expect from our tried and true process:

Start by filling out Broad Financial's easy online application. Simultaneously, open a Self-Directed IRA with our sister company and in-house Self-Directed IRA custodian, Madison Trust.

Fund your Self-Directed IRA by transferring or rolling over funds from an existing IRA or 401(k). You can also fund your Self-Directed IRA with an initial contribution.

Broad Financial will create an entity, such as an LLC or trust, for your IRA. You will then go to the bank of your choice and set up a checking account in the name of your LLC or trust.

At your direction, Madison Trust will send your funds from your Self-Directed IRA to your dedicated checking account. Now you can invest in the alternative asset of your choice with the power of checkbook control. Simply write a check or send a wire from your dedicated checking account.

There are several reasons Broad Financial has earned a reputation as the leader in Self-Directed retirement plans. If you choose us, you’ll enjoy the following benefits.

If you're new to Self-Directed IRAs, rest assured that our team is committed to your success. Our Self-Directed IRA Specialists can answer any questions you might have. We offer our clients the highest industry-rated free, lifetime customer support.

Our Self-Directed IRA Specialists deeply understand a wide variety of alternative asset classes, from real estate to cryptocurrency. When you want to move forward with your investment, we can guide you through the self-directed investing process.

Broad Financial’s Self-Directed IRA doesn’t charge transaction fees or fees based on your account's value. This means you’ll have more money in your pocket to invest in alternative assets and potentially maximize your retirement savings.

If you’re interested in investing for retirement with alternative assets, a Self-Directed IRA from Broad Financial should be on your radar. To get started or learn more, we encourage you to contact us today.

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST