With a Self-Directed IRA (SDIRA), you can invest beyond Wall Street in a variety of alternative assets, such as private placements, real estate, and promissory notes. If you’re familiar with promissory notes, this can possibly enhance your retirement investing strategy. Here’s what you need to know about investing in promissory notes with an SDIRA.

A promissory note is a written agreement in which the borrower promises to repay a certain amount of money in a certain timeframe to the lender. You can think of it as a signed contract that usually includes information like the names of the borrower and lender, maturity date, amount borrowed, payment schedule, and interest rate. It should clearly lay out the key details about the loan and its repayment terms.

Secured notes, such as mortgage notes and trust deeds, are promissory notes that are backed by the borrower's collateral or real property. In the event of default, the lender is entitled to the underlying collateral as the repayment of the note.

These are secured promissory notes where the borrower pledges non-real estate items to the lender, like company stocks or factory equipment. Notes secured by non-real estate are typically riskier due to variables that can impact the collateral's value, such as equipment depreciation and the success of the private company's stock.

Unsecured notes are promissory notes where the borrower does not pledge any collateral to the lender. The loan is made to the borrower based solely on the merit of the borrower's ability to repay. In general, unsecured promissory notes have higher interest rates and monthly payments to reduce the high risk they generally pose.

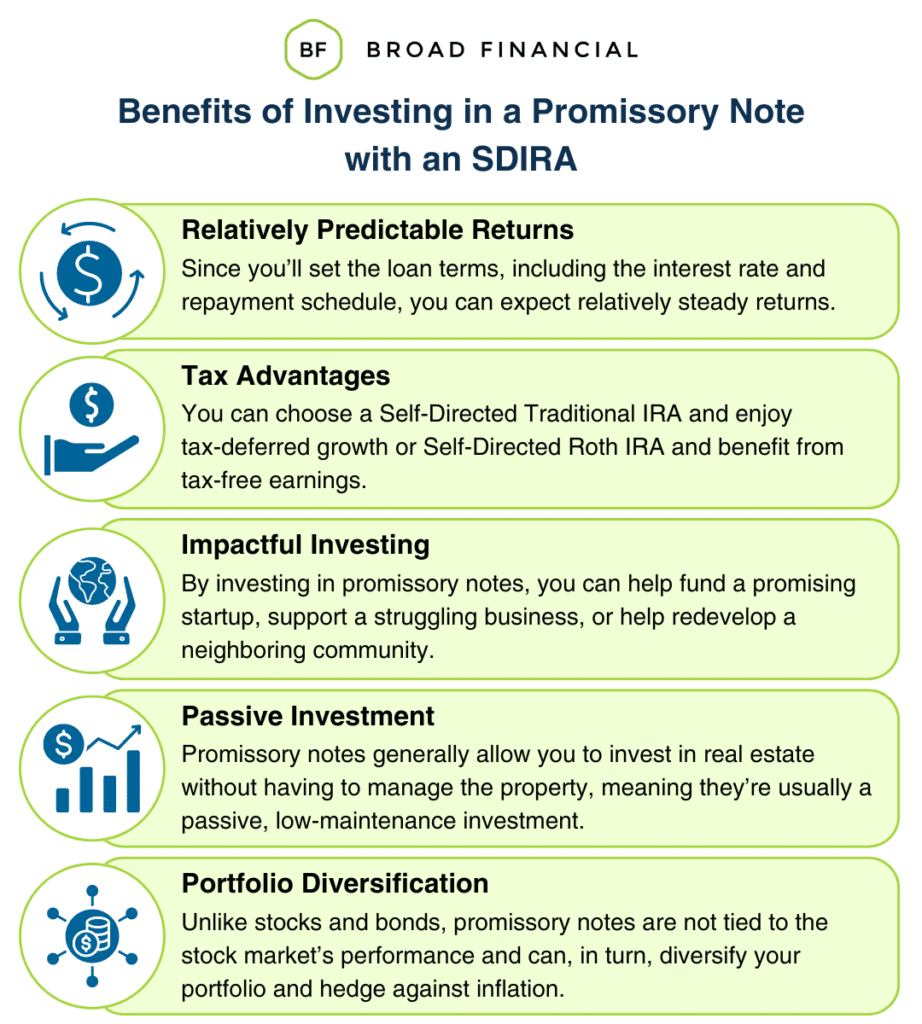

The most noteworthy advantages of investing in promissory notes with an SDIRA include:

It couldn’t be easier to invest in promissory notes with Broad Financial! Here’s what the process entails:

You'll open a Self-Directed IRA with our sister company, Madison Trust by filling out their easy online application. Madison Trust will serve as your SDIRA custodian.

Madison Trust will help you transfer or roll over - all or a portion - of your existing IRA, 401(k), or other retirement account into your new SDIRA. You can also make an initial contribution.

We establish a new LLC or trust for your IRA. You'll then take the paperwork and open a checking account at the bank of your choice. This will serve as your IRA’s self-directed investing platform. You'll then instruct Madison Trust to send your IRA funds to your newly created checking account.

To make an investment, you’ll need the promissory note, which outlines the terms of the loan, and the security document of the loan, such as a deed of trust or personal guarantee. With checkbook control, you can execute your everyday investment transactions by simply writing a check or sending a wire.

If you’re interested in investing for retirement with promissory notes, an SDIRA from Broad Financial can be the ultimate option. To get started or learn more, we encourage you to contact us today.

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST