Individual Retirement Accounts (IRAs) have long been a popular choice for retirement investing. Standard IRAs, however, are just the start of what’s possible with a retirement account. A Self-Directed IRA (SDIRA) functions similarly to a standard IRA. The key difference is that an SDIRA allows you to invest beyond Wall Street in alternative assets such as real estate, private businesses, cryptocurrency, and more. You can also take this freedom a step further with a type of Self-Directed IRA called a Checkbook IRA.

If you’ve been considering opening a Self-Directed IRA, you might also be interested in gaining checkbook control of that SDIRA to turn it into a Checkbook IRA. Here’s what you need to know.

A Self-Directed IRA takes the tax-advantaged benefits of a standard IRA and supercharges them with more investment freedom and flexibility. As previously mentioned, the distinguishing feature that differentiates SDIRAs from standard IRAs is the opportunity to invest in alternative assets.

When placing investment transactions through a classic Self-Directed IRA, you will instruct your Self-Directed IRA custodian to execute the transactions on your behalf. If your investments are relatively transaction-heavy, such as rental properties, you may benefit from checkbook control.

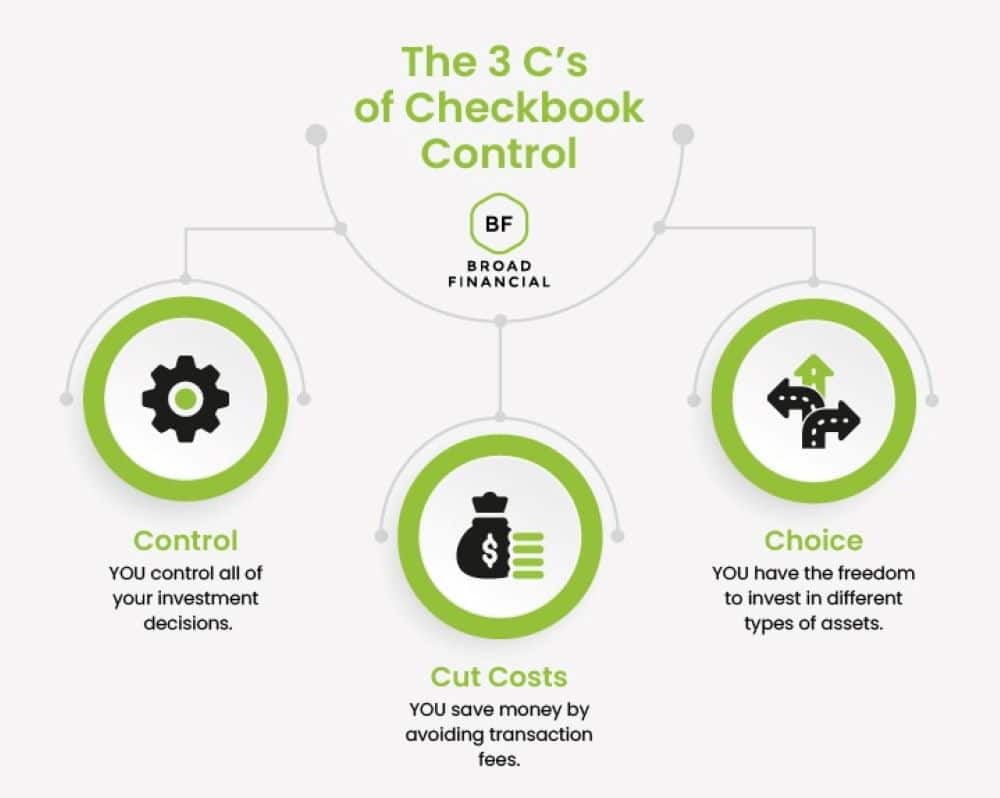

To grant you checkbook control of your Self-Directed IRA, Broad Financial will assist you in setting up an IRS-compliant IRA LLC or Trust, followed by a dedicated checking account for your IRA. Just like that, you have the ability to write checks and send wires for your everyday investment transactions from Checkbook IRA’s checking account. Picture having the power to act on investment decisions in real-time while enjoying tax-advantaged growth of your retirement funds. With Broad Financial’s Checkbook IRA, you gain:

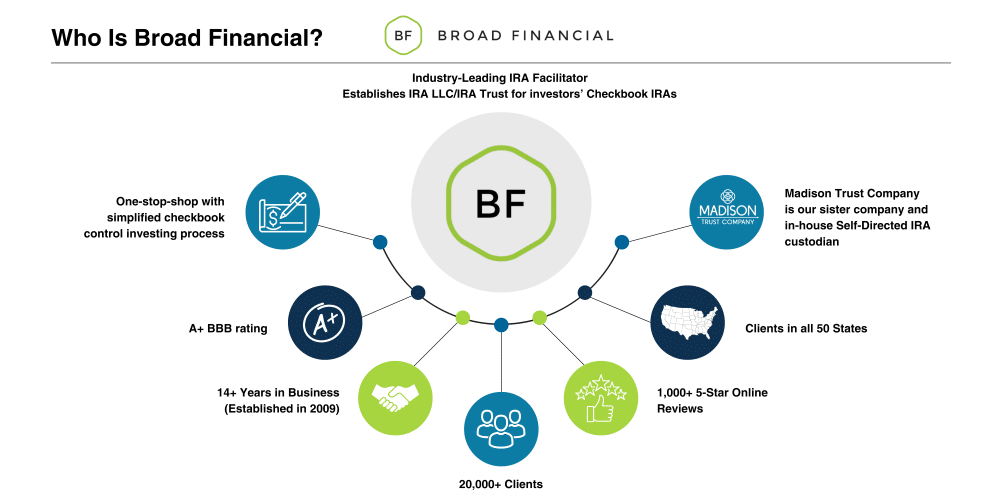

Broad Financial is an industry-leading IRA Facilitator that sets investors up with Checkbook IRAs. We have over 20,000 clients in all 50 states and thousands of five-star online reviews showcasing our stellar client support.

Broad Financial was established in 2009 and built its reputation as an industry-leading IRA LLC Facilitator. On that success, we launched our sister company, Madison Trust, in 2014 to serve as our in-house Self-Directed IRA custodian. Between both companies, you will have a streamlined process for opening and maintaining a Checkbook IRA. Madison Trust is your SDIRA custodian, and Broad Financial upgrades your SDIRA to grant you checkbook control.

Our one-stop shop simplifies the entire checkbook control investing process, ensuring comprehensive support at any step. Over the years, we’ve earned a superb reputation through our relentless commitment to client satisfaction, resulting in an A+ BBB rating. Our Broad Financial specialists are passionate about helping investors navigate the world of Checkbook IRAs.

Now that you understand the power of checkbook control and the benefits of Broad Financial’s Checkbook IRA, you might be wondering how to take the next step. Getting started is simple: schedule a free discovery call with our team. This initial conversation is an opportunity to connect with experts who are passionate about helping you pursue your retirement goals. It's not just a consultation; it's the beginning of an exciting and empowering retirement investing journey. Schedule your free discovery call today!

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST