Tax season is in full swing, and the deadline is swiftly approaching. As you begin to finalize your filings, we compiled a few important IRS tax tips and reminders that may affect your tax preparation. If you’re interested in learning more, feel free to check out the IRS Newsroom and IRS Tax Tip Archive.

Those who have turned 72 years old during the last half of 2021 (those born after June 30, 1949) have until April 1, 2022 to begin taking funds out of their IRA, 401(k), or another qualified retirement plan.

Once you reach age 72, it is mandatory to start taking out RMDs (Required Minimum Distributions) if you own a traditional, SEP, or SIMPLE IRA or an employer-sponsored retirement plan such as a 401(k), 403(b), and 457(b). Typically, RMDs must be made by the end of the year. However, if you reach age 72 in the second half of the year, there is a specific rule applied that allows IRA accountholders and participants in employer-sponsored retirement plans to wait until April 1 to take their first RMD.

The April 1 deadline is only allowed during the first year the accountholder takes an RMD. All following RMDs must be taken by December 31 each year. This means if you turn age 72 in the second half of the year, you will make two distributions in the same year. The first RMD (taken by the April 1 deadline) is the RMD for 2021, however it is taxable in 2022 and reported on the 2022 tax return with your 2022 distribution (taken by the December 31 deadline).

Although RMDs are mandatory for all owners of Traditional IRAs and most participants of employer-sponsored retirement plans, there is an exception to the rule. If you are still working for the employer that sponsors your retirement plan and they approve, you can wait until April 1 of the year after you retire to receive your first distribution.

Note: If you hold a Roth account, it is not mandatory to take out RMDs. The tax-free funds can even be passed down to your heirs.

RMDs are calculated by dividing your prior year-end account balance by the life-expectancy factor in Appendix B of Pub. 590-B. For assistance calculating your RMD for your Self Directed IRA, please feel free to contact a Self Directed IRA Specialist or financial advisor.

The IRS taxes RMDs as ordinary income. Withdrawals will count toward your total taxable income for the year and be taxed based on your individual federal income tax rate and may be subject to state and local taxes. Please be aware that this income increase may push you into a higher tax bracket and affect the taxes you pay for Social Security or Medicare.

You can contribute to your retirement plan up until the tax filing deadline. When contributing to your retirement account, it is important to specify which year you would like your contribution to be counted for, so your taxes can be adjusted accordingly. This can be done simply by stating the contribution year in Section C of the Deposit Information Form.

The Contribution Limits are as follows:

| 2021 | 2022 | |

| IRA | $6,000 ($7,000 if over age 50) | $6,000 ($7,000 if over age 50) |

| 401(k) | $19,500 ($26,000 if over age 50) | $20,500 ($27,000 if over age 50) |

Many accountholders choose to make last-minute contributions to their retirement plan before the tax deadline. This is because qualified contributions to one or more traditional accounts may be tax deductible up to the contribution limit or 100% of the accountholder’s compensation, whichever is less. Speak with a financial advisor to see if this strategy makes sense for you.

If you have a Roth account, the contributions are taxed now so your distributions are tax-free. It is best to speak with a financial advisor to find out which type of account is best to help you reach your retirement goals.

The filing deadline for 2021 taxes is April 18, 2022. The filing deadline is typically on April 15 each year, however this year it has been pushed back due to Emancipation Day. Those who live in Maine or Massachusetts have until April 19, 2022 to file their taxes due to Patriots’ Day.

It is crucial to file by the deadline even if you cannot pay the full tax bill. This is because you may face a failure-to-file penalty, which is 5% of the tax owed for each month/part of the month that the tax return is late with a maximum limit of 25%.

If you cannot file your taxes on time, it is important to ask for an extension by filing Form 4868. Although the IRS does not need an explanation for an extension, some common reasons for requesting an extension include lack of organization or unexpected events.

Even if you obtain an extension to file, it is important to understand that this extension of time is not an extension of pay. This means that you are still responsible to pay your taxes in full by April 18, 2022 but you have until October 18, 2022 to complete the filing.

When you are ready to pay your federal taxes, you can do so through any of the following methods:

Even if you cannot pay your full tax bill by the deadline, it is beneficial to pay any amount you are able to. You will still incur interest and a late penalty after April 18, but even a partial payment will limit these additional charges. Consider your options, such as obtaining a loan to pay the amount due.

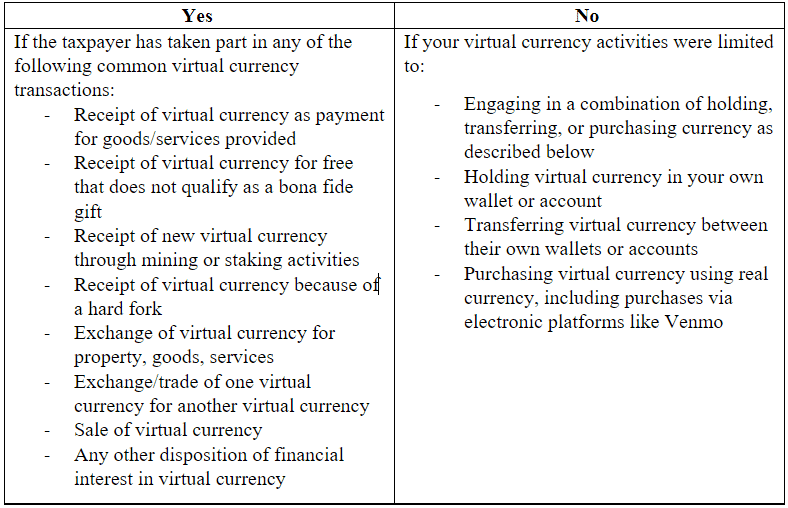

All taxpayers will be presented with the question “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”. If you are a Self Directed IRA investor, you can even invest in cryptocurrency in your tax-advantaged account.

Taxpayers are required to check “Yes” or “No” to the virtual currency question based on their participation in the following transactions.

If disposed of virtual currency that was held as a capital asset through a sale, exchange, or transfer, file Form 8949.

If received any virtual currency as compensation for services or disposed of virtual currency held for sale to customers in trade or business, report the income as you would report other income of the same type (Form 1040, 1040-SR, 1040-NR, etc.).

In recent years, the IRS has made a big push to become more transparent, user-friendly, and to provide taxpayers with practical tools. This led to the creation of the Taxpayer Bill of Rights, which is a list of rights that the IRS states all taxpayers are entitled to.

Here are a few rights that you are entitled to as a taxpayer,

There is the stigma that taxes are dense and confusing and should be done by those with accounting backgrounds. To counter this, the IRS has placed an emphasis on providing clear explanations of laws and procedures on all forms and instructions as well as providing clear information about the IRS’s decisions about your tax account, among many other changes.

The IRS will not disclose tax information to outside parties unless explicit permission is given. Confidentiality laws for accountants and others who practice before the IRS have also been created.

Taxpayers have the right to pursue their claims in the general court system.

Additional rights include The Right to Challenge the IRS’s Position and Be Heard and The Right to Pay No More than the Correct Amount of Tax, among others. For more details and more rights as a taxpayer, please refer to The Taxpayer Bill of Rights Part 1 and Part 2.

Depending on your income, filing status, age, and whether you fall under a special circumstance you are required to file taxes. Although some taxpayers may find the process confusing, the IRS and other financial resources have tried to become more consumer-friendly to eliminate the stigma. There are a variety of IRS tax tips, reminders, and other ways to learn about filing taxes available to you. If you have any questions, reach out to a financial advisor.

Still have questions about Self-Directed IRAs?

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST