Bitcoin, Ethereum, Tether, Solana, and the like prove that digital currency is a billion-dollar industry. Once an enigma, cryptocurrency is now a common alternative investment among monetary geniuses and new investors hoping to foster financial gain.

Purchasing cryptocurrency through a Self-Directed IRA is advantageous because of its potential for tax-free earnings. As crypto’s fluctuations move at turbo speed, expedited transactions are critical. When looking into investing in cryptocurrencies, securing an SDIRA with Checkbook Control is considered an ideal account type. Here’s why:

A Self-Directed IRA allows investments in alternative assets, such as real estate, promissory notes, startups, and cryptocurrency. At your direction, your custodian writes a check or sends a wire directly to your chosen investment. An IRA custodian must facilitate all transactions on your SDIRA’s behalf, per your instruction.

Some transactions may take a couple of weeks to process, which can miss the mark on certain potential crypto investments. This is when the desire for checkbook control surfaces.

A SDIRA is fully capable of attaining checkbook control. To do so, you must establish an IRA LLC, or Checkbook IRA. This type of IRA is retirement dynamite, rocketing you towards real-time investments, minus the paperwork and transaction fees.

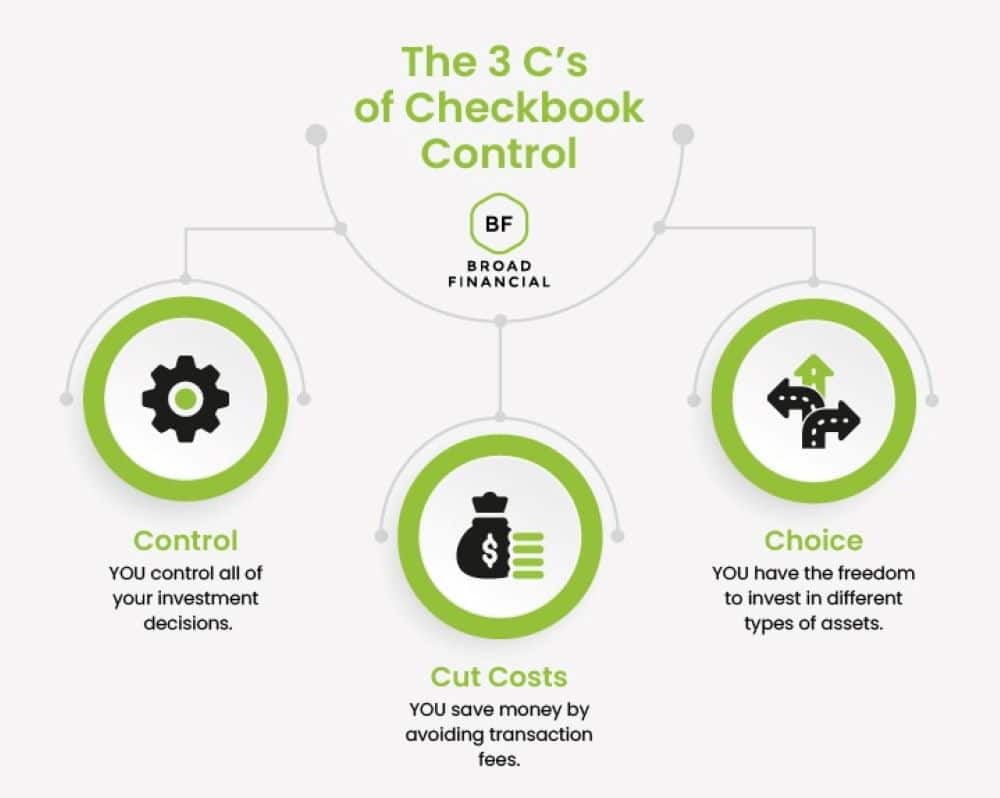

With checkbook control, you can access your IRA funds instantly and execute crypto purchases of your own accord. A custodian is no longer necessary to authorize your everyday transactions. Your account remains IRS-compliant while you simultaneously serve as head architect of the LLC.

By establishing a checking account for your LLC, you now have the sovereignty to invest in whatever crypto opportunity comes your way. All you need to do is simply write a check or send a wire from your LLC’s checking account.

From a bird’s eye view, establishing a Checkbook IRA may seem like a complex procedure. You may be pleasantly surprised to learn how easy it is to generate with Broad Financial.

The first phase is to institute your Self-Directed IRA with our sister company, Madison Trus. You will set up an SDIRA by filling out their online application.

To fund your account, Madison Trust will assist in transferring or rolling over all – or a portion – of your funds from a previously existing retirement account. If you prefer, you can make an initial contribution.

After you have built your foundation, Broad Financial will intercede. By completing the remaining simple steps, your Self-Directed IRA will garner checkbook control.

Establishing an IRA LLC or Checkbook IRA enhances your investment journey by offering liability protection. This provides an extra shield of safety and may bring peace of mind. In addition, you are the sole holder of your private keys, ensuring that your cryptocurrency investment remains secure.

Acquiring cryptocurrency through a Checkbook IRA grants you exemption from capital gains tax at point of sale. You may also trade crypto, tax absent, and have no requirement to report the sale price for every trade. This lets you navigate the digital currency world freely.

Standing as the manager of your crypto investments, you have eliminated all custodian paperwork and transaction fees. Additionally, you have now procured extra funds to put towards your crypto investments.

Alternative investments are an excellent way to diversify your retirement portfolio. Cryptocurrency continues to serve as a leading alternative asset with a potential for high returns. By upgrading your Self-Directed IRA to a Checkbook IRA, you receive transactional freedom and zero transaction fee charges. You are the commander of your own crypto investments, and you can rest assured that your earnings are generally safe and secure.

Broad Financial understands the importance of saving for retirement. We get that questions may arise when going over the necessary rules and regulations. Alongside our sister company, Madison Trust, we strive to structure and support your IRA to achieve your goals. Broad Financial Specialists have knowledge of a wide variety of asset classes and are here to help you along your self-directed investing journey!

Are you interested in investing in cryptocurrency with your retirement funds? Speak with a Broad Financial Specialist to get started today.

Disclaimer: Broad Financial LLC does not provide legal, tax, or investment advice. Please consult with your tax or legal advisor before making investment decisions.

Address:

One Paragon Drive

Suite 270

Montvale, NJ 07645

Phone: (800) 395-5200

Mondays – Thursdays: 8:00 am – 6:00 pm EST

Fridays – 10:00 am – 4:00 pm EST